7 Things You Need To Know About The Coming Estate Tax Amnesty. This will make you cry…

Meet my unlucky, but lucky friend, Ariel. I call him unlucky because he was an orphan at such a young age, but I can also say he is lucky too, because this orphan has inherited properties from his parents and his grandparents.

Unfortunately, all his inheritance from his parents and grandparents were still not yet transferred to his name because the estate tax has not been taken care of. When his parents died in the year 2015 and 2000, respectively, and his grandparents, both in 1998, they were still covered by the previous estate tax computation which appears below:

Old Tax Rates

Effective January 1, 1998 up to 2017

In addition, the old law states that the estate tax should be filed within six (6) months from decedent’s death or else a 25% charge will be imposed and if Estate tax if not filed and settled within the prescribed period will be charged 20% yearly until it is settled.

You see, estate tax charges and penalties are like a taxi meter, the longer you are in the taxi and not paying, the higher the charges and ultimately the payment you will need to pay.

When they (Ariel and his wife) had the tax computed last 2017, the tax they needed to pay amounted to 3M pesos (Basic Tax + Penalties). Because they don’t have liquid money to settle that, they failed to settle the estate tax.

Now that there is Estate Tax Amnesty, what is the effect of that today should they avail?

These are some valid FAQ to consider in availing the Amnesty:

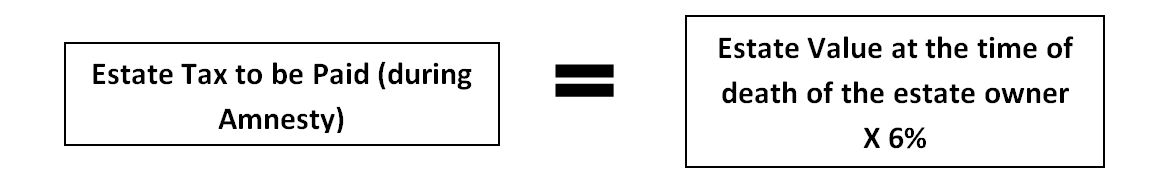

1. What would be the basis in computing the estate tax with Amnesty?

- The estate tax computation will be computed as:

- A fixed estate amnesty rate at six percent (6%) for each decedent’s total net estate tax at the time of death without penalties at every stage of transfer.

- The properties shall be based on the fair market value as of the time of death of the decedent.

2. What will happen to the surcharges?

- There will be no surcharges during this Amnesty. Surcharges will be waived.

3. How long can the Amnesty could be availed?

- 2 years from the release of the IRR. The IRR will be release this May 2019. (as they say in their press release)

4. What will happen if the heirs fail to avail the Amnesty?

- The computation will go back to the original estate tax table before the enactment of Train law plus the surcharges and penalties.

5. What if upon computation, the payment computed is zero or very minimal?

- It cannot be “no payment.” It prescribes a P5,000 minimum payment for transfer of the estate of each decedent who died on or before December 31,2017.

6. What are the exclusions of this Amnesty? Can everyone avail this?

- Excluded from the amnesty program are cases falling under the jurisdiction of the Presidential Commission on Good Government as well as unexplained wealth or unlawfully acquired wealth under the Anti-Graft and Corrupt Practices Act.

- Cases involving money laundering, tax evasion, fraud and malversation cannot avail of the privilege.

- Also excluded are delinquent estate tax liabilities which have become final and executory covered by tax amnesty delinquencies.

7. What are the preliminary initial requirement should anyone be preparing?

- Original and Certified true copy of Title of land or property

- Updated Real Property Tax payment

- Death Certificate and IDs (I hope you can still have a copy) of the estate owners

- Birth Certificates, IDs (Government issued with photocopy) of all the heirs

- Preliminary meeting of all the heirs on how they will decide to divide the properties if there is no Last will and testament of the dead estate owner

- And of course Money for processing of papers which includes: Judicial (lawyer fees), Transfer of Title/Registration fees and the approximate amount of actual Estate tax that needs to be settled.

My personal take on this if you are going to ask me?

If this is your concern, then, the waiting time is over. It’s time to settle your estate during this Amnesty for once and for all. If the Amnesty is over and you did not take advantage of this, you may not be able to get this bargain offer ever again.

If money is your concern, do whatever it takes to do it now. If you need to take out a loan just to settle this, then do it. Just do it, you only have 2 years to settle this or else, BIR is back to its regular programming and regular rates of 20% + surcharges. The more you cannot settle it if the amnesty espires.

In the title, I told you this Estate Tax Amnesty will make you cry, which can occur in 2 ways:

- Cry for joy – for this golden opportunity, or

- Cry for despair – should you miss this and let the opportunity pass.

I hope this post helped you in any way it can.

For Your Financial Health,

Read More:

- The Essential Guide to Estate tax under TRAIN law

- How to Compute and File The 2nd Quarter Income Tax Return (TRAIN Edition)

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

This was really good news I recently calculated the estate tax required to transfer my grandma’s plot of land 2017 rates vs Tax Amnesty and it was almost twice the amount

However it’s still a lot of money pouring out of my family’s pocket… I do hope to settle this within two years or earlier

and my follow up question is the calculation of the estate value under the tax amnesty will this condition still apply?

*The properties shall be based on the fair market value as of the time of death of the decedent.*

Yes, only under the tax amnesty, so you need to settle it during the amnesty.