8% OPTIONAL FLAT RATE vs. GRADUATED RATES, WHICH IS BETTER FOR Self-Employed Doctors?

This is the most common question I get from doctors nowadays, even from non-doctor friends. Section 109 of the Tax Code, as amended by Section 34 of RA 10963, the new option of the TRAIN for self-employed taxpayer is the availment of the 8% flat rate over the graduated rates.

Let us take a look at this more closely and more intensely.

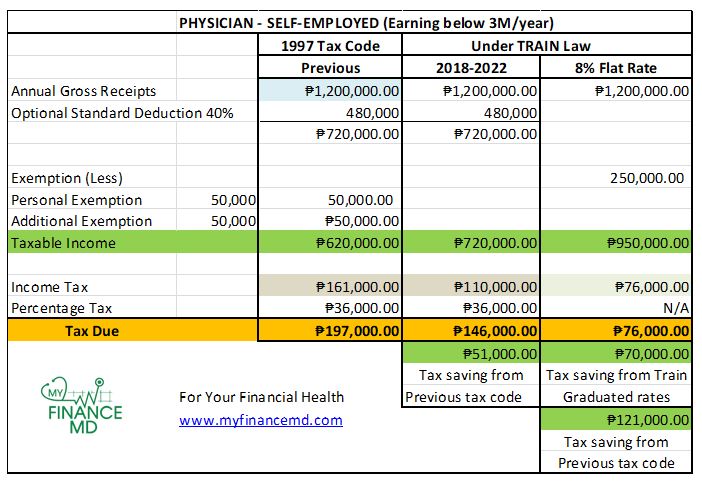

Sample 1: Dr. Jonas is earning Php 100,000 per month or Php 1,200,000 per year. He was previously being withhold 10%, paying 3% percentage tax, quarterly income tax and the annual income tax return. Will getting the 8% flat rate will benefit him more under the TRAIN law or does he stay in graduated rates plus 3% percentage tax?

He has 2 kids. (Note: This is only useful in computing the old tax code – this will give him 50,000 additional exemption)

Now, let’s compare:

To answer the question of where can he benefit more? You be the judge.

He will save Php 70,000 more using the flat 8% rate vs the graduated rates.

There are questions that I also receive that tells me they were advised by other people that graduated rates are better than the flat 8% because of the 40% optional deduction that can be used in the graduated rates or the itemized standard deduction that could be used as deduction:

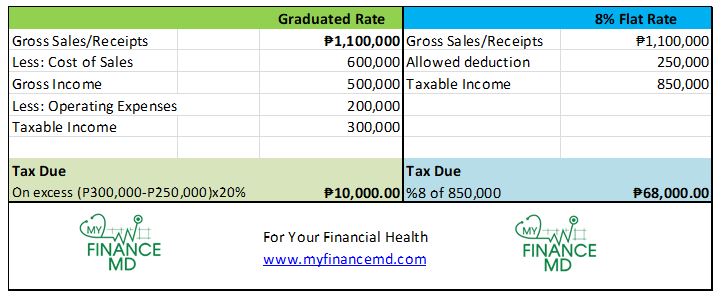

I searched for an instance that a graduated rate is better than the flat 8%, so here it is:

Sample 2: Ferdinand has a small business on which gross sales is Php 1,100,000, cost of sales is Php 600,000 and operating expenses amounting to Php 200,000.

Source: #AskTaxWhiz Train edition

If Ferdinand will be using the flat 8%, he will pay Php 58,000 more than using the graduated rates. Since he is using the itemized deduction, he can deduct all his business expenses from his gross receipts.

Other frequently asked questions (FAQ):

- Who can avail of this optional 8% flat rate?

The optional 8% flat rate is available to purely self-employed individuals and/or professionals who are non-VAT registered (earning <3M/year).

- How to update my COR if I would like to avail of the 8% flat rate?

Fill up Form 1905, attach the original COR, Form 0605 and letter of intent that you want to avail of the optional 8%. This should be done until March 31.

- Last year, I was a VAT registered taxpayer, earning 2.7M/year, can I avail of this 8% flat rate since now I am below the new threshold of 3M per year?

Yes, but you have to first change your Certificate of Registration (COR) from VAT Registered to Non-VAT Registered before March 31 of this year.

Once you have successfully changed your COR, you need to signify that you want to avail of the 8% flat rate by following the above instructions.

Once you availed of this option, you don’t need to file and pay percentage tax of 3% per month. You only need to file form 1701Q quarterly.

- What if I paid the percentage tax for last January since this 8% flat rate is a fairly new rule so I was not able to do this immediately, can I still avail of the 8% flat rate? What will happen to my payment?

Yes, but you have to ask your respective RDO on procedures for this. As I asked around, different RDOs have different procedures right now. Maybe because this law has not yet been properly coordinated during this time.

- What are the new deadlines of filing?

Since you are no longer filing for the percentage tax, you only need to file the 1701Q quarterly.

1st quarter: May 15

2nd quarter: Aug 15

3rd quarter: Nov 15

Annual: April 15

- If I have Form 2307 in filing my quarterly, how do I use this? Do I need to pay anything?

Yes, you need to use this in filing your 1701Q as these are proofs that you have been deducted 8% withholding tax from your income.

It may also mean that you don’t need to pay anything anymore. But for your gross/income receipts that don’t have 2307, you still need to pay the 8%.

My Finance MD Recommendations (Rx):

- As you can see, the benefits will depend on the circumstances. For a business with a lot of operational expenses and cost of sales that they can deduct, graduated rates will be a better choice.

- But in my opinion, since doctors are usually self-employed that has minimal operational costs that they can use to for deduction, the 8% flat rate will be a better choice.

- You still have a choice, I hope you were able to read this blog post before the deadline and you can still avail of this.

- If you care for your fellow friends and colleagues, kindly share this post, now.

UPDATE on TRAIN:

RR 11-2018

For Gross income 3M and below, the Creditable Withholding tax on Professionals will be from 8% to 5%.

For Above 3M, it will be 10%.

Thank you for always reading my financial health advisories. Please wait for the ultimate upgrade of MYFINANCEMD. As my way of thanking everyone for reading my blog, some has become my friends/clients and some are inviting me to speak in their respected medical societies even non-medical corporates. To God be the glory.

Stay updated and financially healthy.

Did you like this article? This was discussed intensively in my latest book:

Don’t forget to grab your copy! To order CLICK HERE. Limited copies available.

For your financial health,

Read More:

- 8 Facts Doctors Need To Know About the TRAIN and How It Will Impact Your Income Tax

- The Essential Guide to Estate tax under TRAIN law

- Why are Most Filipino Doctors not RICH? Top 5 Obstacles Keeping Filipino Doctors from Becoming Wealthy

- 6 Secrets of Becoming the RICH DOCTOR Your Friends and Family Think You are

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

I am a self-employed MD but also started receiving compensation for a part-time employment. Can I avail of the 8% flat rate?

yes, if you are not earning more than 3M in a year.

as long as your income does not exceed 3M a year and you signify your intention to avail the 8%.

I want to opt for 8% flat rate, but have just come across the tax advisory issued February 2018, stating “There is no need to file and pay monthly percentage tax on their monthly gross receipts using BIR Form No. 2551M.” Can I still opt for 8% flat rate on the 1st quarter and not file 2551M from here on? What would happen to the payments I’ve made for Jan and Feb? Thank you.

Just want to share: i was told by the BIR officer of the day that i should make a request letter for refund address to BIR, then attached these to your letter:

>photocopies of 2551M forms submitted for the month (Jan. & Feb.) and receipts

>photocopy of updated COR w/ note availed 8% .

>photocopy filled up form 2551Q and confirmation letter received in email

(To Fill up 2551Q Form: under #3 choose first quarter; #4. amended return: yes; under #14c- w/taxable amount: zero; under 20B- the total amount (Jan & Feb) to be refunded; under #24 if overpayment choose option: To be refunded)

Attached these to your letter and submit it to the admin. dept of your designated BIR office.

thank you so much for all these informations regarding the TRAIN law : )

If I missed the deadline for filing 1905, can I still avail of 8% flat rate by indicating on my 1701Q for 1st Q that I’m opting for 8% flat rate?

Whether I’m availing for graduated percetage tax or 8% flat rate, I don’t need to file 2551M anymore?

Thank you.

Hi! Would like to ask, if one opts for the 8%, is there no need to file 2551Q? Just 1701Q? Thanks!

Yes no need for 2551Q

how do i know if my quarterly is graduated it rates or 8% it rates

You should apply for the 8%. If you did not, the default is graduated rates.

How about for full time home-based professional consultants? Can we apply for the 8%? Will the Mar 31 deadline still be applicable if we started the work past the deadline? We have no COR, what would be the requirements to avail the 8%? Thank you.

Hi Dr. Pinky! I find your website so informative especially on the new TRAIN Law than when I went to my RDO to ask about it. They were all masungit and had no time explaining the new ruling. My husband and I are both non-vat registered. Since it’s understood that we didn’t signify our intention for the 8%, automatically we are using the graduated rates.

1. I filed my monthly 2551M for the months of Jan to March and the 1701Q first quarterly tax for 2018 in April since there was not yet a clear guideline as to what to do and the new forms were not yet posted. Do I need to file again the 1701Q for May using the new form even having paid in April?

2. My husband uses EFPS online payment but the new forms are not yet available and it still uses the old 1701Q form. Do we still file it using that?

3. Lastly, I read several posts which got me confused. If I am not availing the 8%, what form should I accomplish for the quarterly tax? Is it the 2551 or the new 1701Q?

Hi Jake, I think you need to ask your RDO if you need to pass the new 1701Q form. Tell them if you need to amend your previous filed form. If you are availing the 8% you should have not paid for the percentage tax 2551Q. Only the 1701Q.

hello. my sister is a physician, and she applied for the graduated tax rate. She received 2307 from her employee. Does she include 2307 in filing her percentage tax? thanks for the reply.

No. It’s not included.

Sorry for the late reply.. Thank you.

If I used graduated rates last year but would like to change to the 8% rate this year, how do I go about it? Will this step need to be done yearly? Thanks so much.

You need to inform BIR that you are changing to 8% and yes, this is done yearly, beginning of the year. and what you decide on will be enforced for the entire calendar year.

Hi Dr Pinky! Thanks for this. I have a question. For annual income tax computation for mixed income earner (doing private practice and has a govt hospital compensation) availing of graduated tax rate, do you add the taxable compensation and the taxable income in private practice to come up with the taxable income? I noticed that by doing this, graduated tax rate would be at a disadvantage because the taxable income increases (as compared to 8% flat rate where the compensation in cancelled out by the taxwithheld by the govt hospital) Or should it be filed separately?

Thank you!

Taxable income is equal to the income earned thru employment and income from doing business (sales less expenses). In computing the compensation income, the employer also uses the 250k threshold.