Doctor’s Dilemma: How to Build Doctor’s Retirement Fund?

Most medical doctors I know are private practitioners. They are not employed, hence, they are not an employee of any company. Meaning to say, they run their own game and they don’t get any benefits from any company. All that they have are what they call “sariling kayod.”

Since they won’t be getting any retirement benefit from any company, except from SSS if they do contribute, I ask doctors on how they plan to retire. They usually tell me, they plan to work hard, save and create a business that can support them throughout their retirement years.

Putting up a business? Is that the only option?

Don’t get me wrong, I do believe putting up a business is good. But, from practicing medicine all your life and then becoming a business man, takes time and has a learning curve that is often too steep for most doctors. Starting a business may be easy, but keeping it profitable takes talent, skill and dedication. Many Doctors may not be ready for that.

But why do most doctors plan on doing it anyway? Is it because they wanted to build a passive income for their retirement?

Maybe, yes. But, is that the only way to set up your retirement fund and creating passive income?

Let me introduce you to another option.

Meet my three friends.

Introducing, Dr. Now, Dr. Wait and Dr. Late.

They are friends since medical school.

From the group:

Dr. Now – is the adventurous one, he was the action man of the group. He wants to do things always on NOW NA. He is always on the go. He does not want wasting time.

Dr. Wait – Is the cautious one from the group. The O.C. He wants to make everything meticulously perfect first before doing and deciding on things.

Dr. Late – is always late in everything. In their conferences, endorsements and meetings. But even though he is always late he still get things done. Late nga lang.

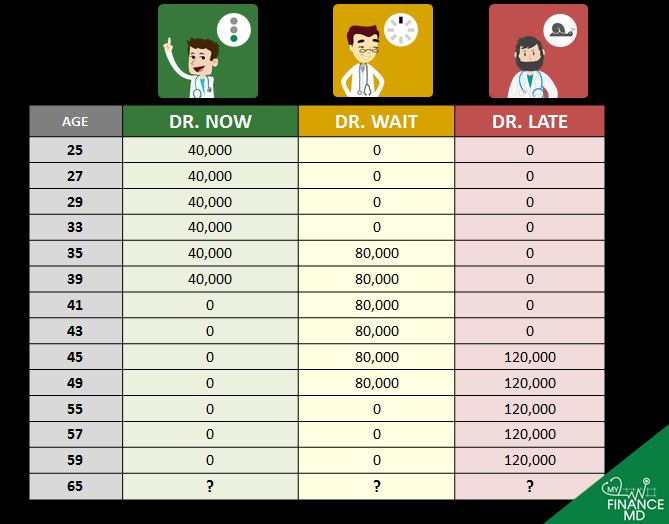

They are all friends in medical school. When they were 25 years old, they were introduced on Savings and Investment by a Financial Consultant.

Dr. Now, said, “Ok, I will invest now, but maliit lang ang amout since, we are still residents. I can only afford: 40,000/year.” So, he did, then, he stopped after 15 years.

Dr. Wait, said, “Tsaka na. Pag I already have my own practice.” So he did it after 10 years at age 35. But instead of 40,000/year. He saved more: 80,000/year also for 15 years too. He wanted to catch up.

Dr. Late, when he was 25, said, like Dr. Now, he said, “sige mag invest ako.” When Dr. Wait started investing, he said, “oo ako din, Basta mag invest ako.” In short, he always procrastinates. Up until age 45, he is already a renowned consultant, he said, “sige na nga it’s time. Pero mas marami na akong pera, kaya I will invest, triple of Dr. Now.” He invested 120,000/year for 15 years too. Triple of that with Dr. Now, and double of Dr. Wait.

In your opinion, who saved More? Now, they are already 65 years old, about to retire. They looked at their investment.

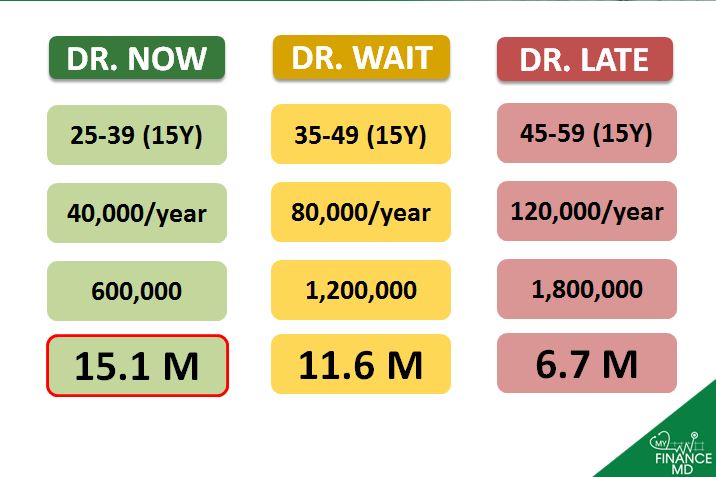

Here are the results:

At 10% compounding interest, at their 65 (Age of Retirement):

Dr. Late – investing almost 1.8 M for 15 years, got 6.7M

Dr. Wait – investing a total of 1.2M for 15 years, got 11.6M

Dr. Now – investing only 600,000 M for 15 years, got 15.1M for his retirement.

Wow, the guys who invested more, double (Dr. Wait) and triple (Dr. Late) never caught up with the Guy who invested early (Dr. Now)

Who among you, reading this article who are under 40?, You are? ? Then, listen, I am speaking to you:

Do you understand that if you gather these information, put it in your brain, changes your heart and you did something about it, this one chart above will make you a multi-millionaire. I just made you a multi-millionaire. Am I right older people?

How many of you reading this article are over 40? Admit it! Be proud of it! I know deep inside you wished you could have read this article years ago and did something about it. What you are feeling now, it is called “regret.”

Some people ask me, “Am I too old to save money?”

What I say to them and to you:

“Not if you are still breathing. Cause I bet you cannot go backwards, and your only option is start where you are and let’s go. There is still hope. The methods on how to reach your goals may be more difficult if you started 10-20 years ago, but there is still a way. You just needed to be guided.

From the funds available for Dr. Now. If you also have these funds available for retirement, right now, wouldn’t these create your retirement fund and earn you a passive income to last throughout retirement years.

Lesson: Do it NOW!

Before I end, I want to ask yourself? Are you Dr. Now, Dr. Wait or Dr. Late?

I am here to guide you,

This article is part of my talk “Retirement: Life After Medical Practice”

Want guidance from a Internationally accredited Registered Financial Consultant? Ask me, it’s for free.

Read more:

- Retirement: Life After Medical Practice

- 6 Secrets of Becoming the RICH DOCTOR Your Friends and Family Think You are

- Why are Most Filipino Doctors not RICH? Top 5 Obstacles Keeping Filipino Doctors from Becoming Wealthy

- FILIPINO DOCTORS AND TAXATION Part 3: How to file INCOME TAX RETURN as a Physician

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Very nice and very applicable article. Clarification though? If Dr. Late saved for 15 years at 120,000 per year, should that be at 1.8 million? (120K * 15 = 1,800,000) and at 65 years of age therefore at 6.7 M? Thanks!

Thank you. Will correct it. 🙂

Very relevant example that applies to everybody. Pray many become aware and take immediate action. We have one of the lowest savings rate in Asia and the bottom quartile of financial literacy. For Dr. Late saving 15 years at 120,000 per annum, should this be at 1.8 M total investment? And gets to be 6.7 M at his retiring by 65? Thank you and more power! May there be more like you to educate our people and bring the financial awareness and accountability. A financially healthy citizenry, will help build a financially healthy nation, thereby a sustainably progressive Philippines.

Thank you.

Did the necessary correction. Thanks on your input.

When you say invest now, what do you mean? Where should we invest?

there are different investment vehicle we can use doc. Depends on your needs, situation, budget and dreams. So, you really need a personalized help with that. You can email me here: docpinky@myfinancemd.com

Thank you Doc! Mind is i share this to my page?

Sure

where can i invest?

Hi Pls emalii me: docpinky@myfinancemd.com so I can help you