One fine day, while talking to my friend Billy, I asked him. “ Do you have enough life insurance?”

One fine day, while talking to my friend Billy, I asked him. “ Do you have enough life insurance?”

He told me, “Yes, I already got several and I think I don’t need another one right now.”

I ask him again, “Are you sure, you have enough?”

He suddenly stopped, looked at me and said, “I am even worth more dead now than alive.” After looking at him more intently, he said “Okay, Okay!, now, you got me curious, tell me, how much do I exactly need?”

Well, Billy, All I can say is, “it depends.” It depends on these questions.

- Do you have any dependents? Meaning: does someone depends on YOUR salary to survive? (eg. Child, spouse, parents, siblings). Anyone who will suffer if you are suddenly taken out of the picture?

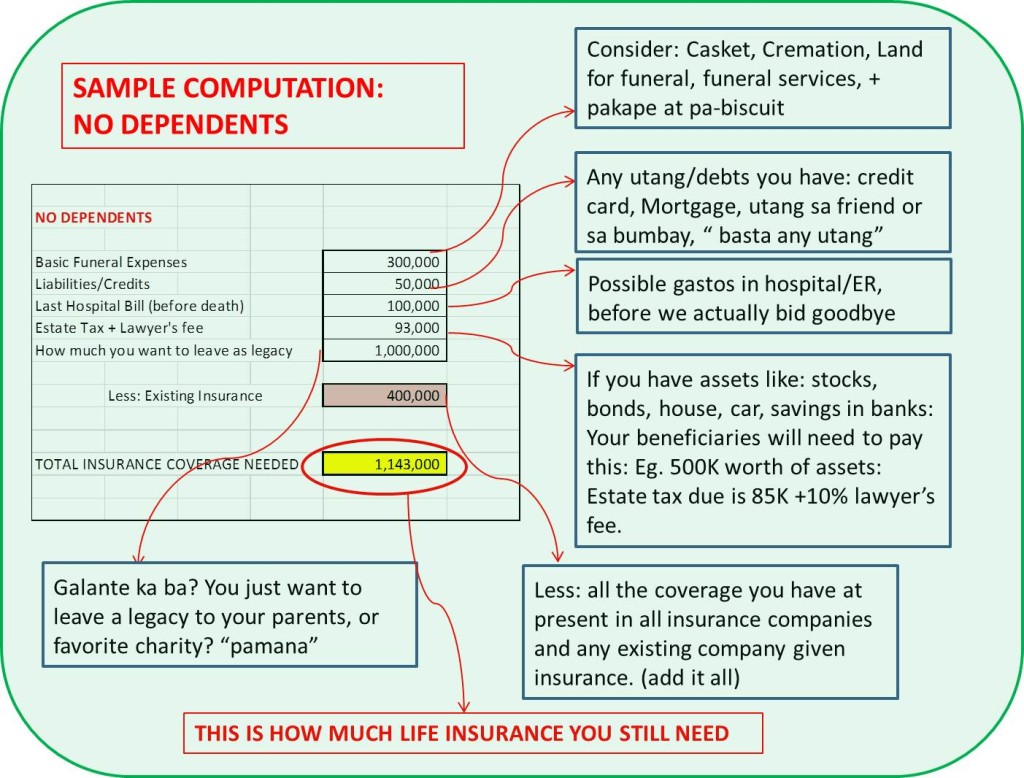

THIS IS YOUR SAMPLE COMPUTATION: Figure below will show the computation of Final Expenses (expenses you will incur when you are suddenly taken out of the picture) + Estate tax and legal obligation LESS existing insurances.

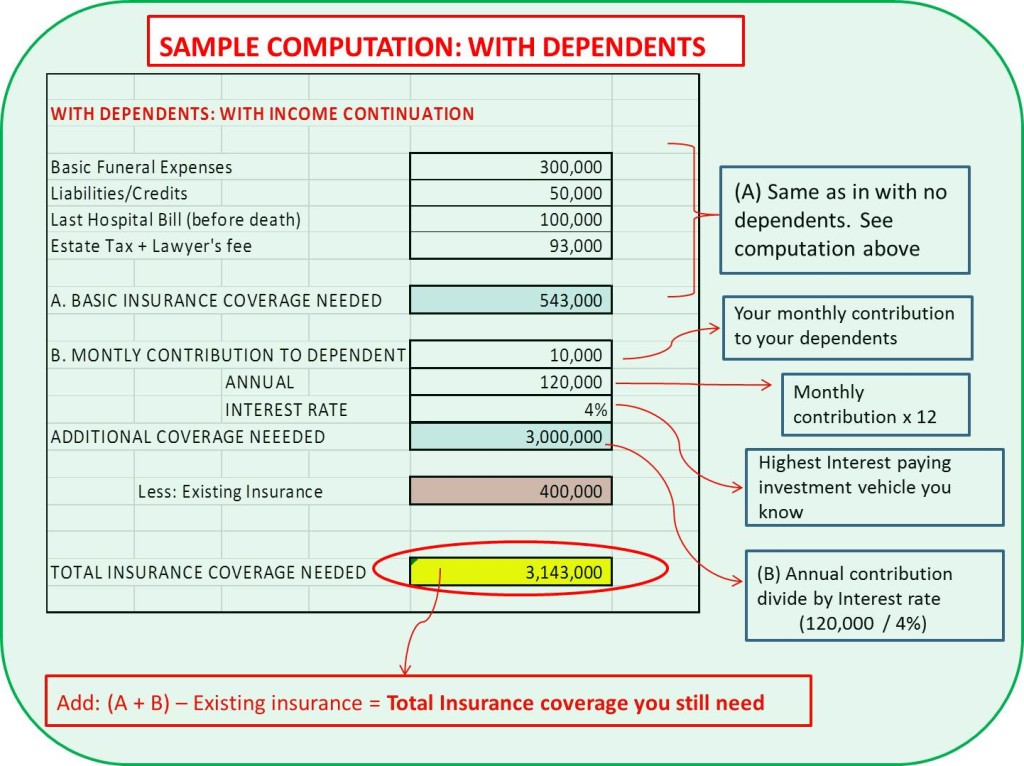

If your answer is YES:

Additional questions for INCOME CONTINUATION (if you want your monthly contribution to your family will continue even if you are not around anymore).

1a. How much do you contribute to them exactly on a monthly basis? (e.g. 10K/month)

1b. Is it important to you, that if in the event that you die early, your monthly contributions to them will still continue?

1c. Do you know of any investment instrument/bank that gives a high interest per year? If yes, how much in (%?) (Eg: 1% in time deposit, 6% in bonds, 10% in equity, 4% in some cooperative)

If you tried computing yours, Congratulations!!! You now know how much exactly you need. But still, you need to update that yearly, especially if you have new dependent, or you have accumulated new assets that will add up to the computation of your Estate Tax.

As for our friend Billy, when we computed his, he still needs additional 500,000 coverage. And yes, he bought another one!

If you find the sample computations above, tedious, I will give you computation on how to do the rough estimate.

The rule is: (Annual Salary Multiply by 10)

The answer will be the rough estimate of how much insurance you require. Although this method is not ideal, this is better than guessing what you need.

Now, you might want to visit your policy contracts, add everything up if you have multiple policies and take a look if you are UNDERINSURED or OVER-INSURED. If you still don’t have one yet, this may be the time to get one.

When it comes to planning your future, NOW is always the best time to start. To learn more about Life insurance or if you need help with your financial plan/ goals, I will help you make it happen. Feel free to contact me.

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

so love your strategy for explaining clients needs in the simplest manner. keep up Dr. pinky de leon. god bless and more power to you

Wow, thanks for the complement. 🙂 keep updated for new posts in the next few days. Hope it could also help you with your clients. 🙂

Congratulations Registered Financial Consultant! Very informative… God bless.

Very clear. You can never tell that you are fully insured, unless your loss will not be felt in many ways. Like in income continuation, fullfillment of your obligation and the like. Physical presence will really be felt but your financial support will still be there because you still continue to answer your left behind unfinished obligation by leaving your dependents an insurance coverage proceeds that is x10 of your annual income. In fact, they may live by the interest earnings only of the total proceeds of your life insurance by working back the formula…….

Yes Ms Debbie, you have also a good point with that 🙂

A great thing to prioritize 🙂

Hi Ms. Pinky 🙂

Just curious, why did you divide the annual income contribution by the interest rate? And how long will this income protection last?

Thanks in advance 🙂