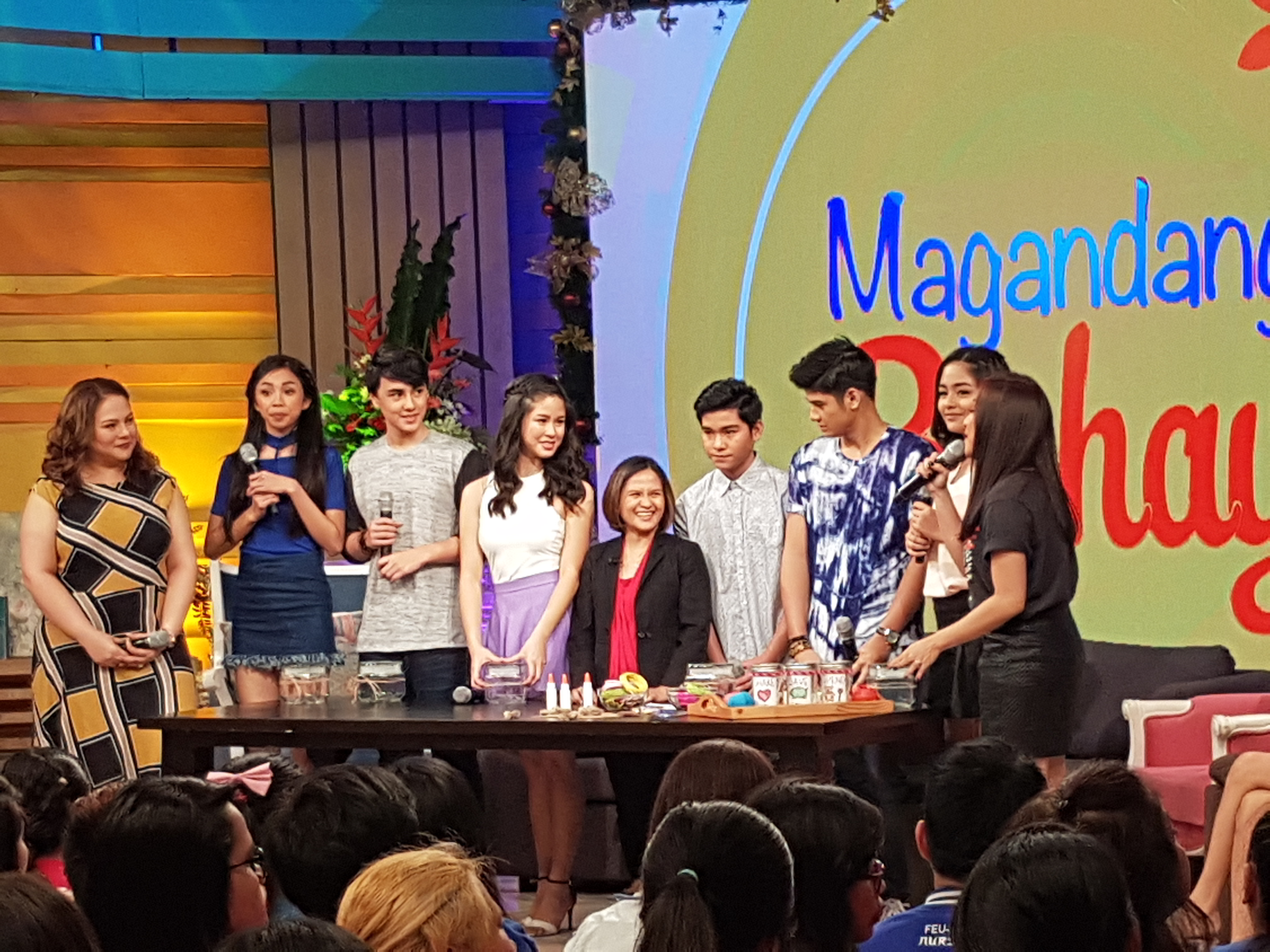

Last Monday, I was invited to guest in the TV show “Magandang Buhay” in ABS-CBN. It was both nerve wracking and fulfilling experience. Nerve wracking because it was a “live show” so, to those who were able to watched the show, forgive my clumsiness and self-consciousness. Fulfilling also because after the few minutes of fame, there are numerous messages that I received both from my emails, and FB that they were inspired to become more financially literate, some said they will do the activities for their kids and many learned a lot from my simple discussion, and they ask me to explain the money jars even more.

Last Monday, I was invited to guest in the TV show “Magandang Buhay” in ABS-CBN. It was both nerve wracking and fulfilling experience. Nerve wracking because it was a “live show” so, to those who were able to watched the show, forgive my clumsiness and self-consciousness. Fulfilling also because after the few minutes of fame, there are numerous messages that I received both from my emails, and FB that they were inspired to become more financially literate, some said they will do the activities for their kids and many learned a lot from my simple discussion, and they ask me to explain the money jars even more.

I admit, I was not able to explain the concept explicitly because of limited time in the show. For that, I will explain in this blog post:

According to a study from the University of Cambridge, kids’ money habits are formed by age 7. Hence, the earlier we can teach our youngsters about money, the better their money habits are starting to be. We can start teaching the “piggy bank” at age 2.

Then, at age 3, since they can now grasp financial concepts, from a piggy bank, we now break it into 3 money jars (the basic) money jars, namely the: Save, Spend, and Share Jars.

For Spend Jar:

Have her use the spending jar for small purchases like stickers or small toy.

For Share Jar

Money from the sharing jar can go to church when you go to the Sunday mass. It is a chance of teaching your child the concept of ‘tithing’ or giving to the Lord. Or you can opt to give you charity, it depends on the belief system of the family. But this jar would teach our children that sharing is important.

For Save Jar:

This is the jar for bigger goals. You are teaching her to save for a goal.

How to do it:

Have your child set a goal, such as a toy. Make sure it’s not so pricey that she won’t be able to afford it in a few months and she just gets frustrated.” Every time your child adds money in the savings jar, help her count up how much she has, talk with her about how much she needs to reach her goal and when she will reach it. “All those behaviors are really fun for kids,” says Kobliner the author of the best selling book “Get Financial Life”. “It gives them a sense of importance of waiting and being patient and saving.”

What are the lessons kids can get from this activity:

- Budgeting

According to the study, only 33% of Filipinos do budgeting. It is one of the most important steps towards financial freedom that each person should do.

“A budget is telling your money where to go instead of wondering where it went.” – Dave Ramsey

- Planning and Saving for a Goal

If the kids learn this very important lesson from the money jar concept, that would be very beneficial for their future.

A lot of adults today do not even know how to plan for their future.

Financial goals of adult life could be investing for retirement, education of kids, and saving for emergencies.

It is technically working for your dreams and making it happen.

- Delayed gratification builds character

Delayed gratification is the ability to resist the temptation for an immediate reward and waiting for a larger or more enduring reward later.

Many adults today are an impulse buyer, they are the ones that has what we call “One-Day-Millionaire Syndrome.” Learning on fighting impulses early and knowing this concept early in life would make one a more responsible adult.

It may mean, to buy all the things I want now?, Or to buy only the things that I really need? And save some for my future retirement or other financial goals. It is a choice between fleeting sense of fulfillment of things now or a better and more lasting reward later on.

Final Note to Parents of Millennials:

According to a study by Visa, “Connecting with the Millennials,” the majority of Millennials are ambitious and money oriented, 81% of them want to make as much money as possible so they can enjoy better life experiences and can get where they want in life.

In the same study, they found out that 89% of Filipino Millennials relied mostly on parental advice. Only 8% of Filipino Millennials are more likely to seek professional financial advice.

This could be both a “good” or a “bad” news.

Good – if the parents of these millennials are financially literate themselves. They can teach their kids well on how to handle their money.

Bad – if the parents of these millennials are equally bad in handling and managing their own money. That is the same skills they will hand over their kids.

Another problem is this:

According to Standard and Poor’s (S&P) Survey last year on Financial literacy of Filipino adults, generally, only 25% are financially literate. Which means there are more “bad” than “good” on matters of teaching our kids about finance.

This is now the greatest challenge of my fellow parents. Learn and study. Be financially literate. Don’t be afraid to ask the financial experts. Learn from them as much as you can, this knowledge is one thing you can pass on to your kids. It is never too late to start learning.

Don’t know how to begin? Ask me here.

Wishing you all a Maganday Buhay,

Read more:

- Millennials and Money: Are they in Sync?

- Money Learning Activities for Kids

- 5 Money Habits to Avoid Telling your kids

- No Spouse, No Kids. How to Grow old Alone?

- How to Save for your Child’s Education

Thank you for the following for inviting me in the show:

Ms. Jasmin Pallera

Ms. Kathy

Mr. Marc Infante

Mr. Kayla Pontigon

To all the show hosts (Karla, Jolina and Melai) and co-guests: PBB teens 2016

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023