As I always say, if you are working and you if you still don’t have a Retirement Plan right now, then your CHILDREN becomes your RETIREMENT PLAN. Mean? Yes! But true.

Statistically speaking, only 2 out of 100 Filipinos plan for retirement. Although most Filipino workers have some kind of benefits like SSS or GSIS or company given benefits. How would you know if it is enough?

How do you compute how much will be your retirement pension from SSS when you retire?

Is your SSS retirement benefits enough? Read on and I will show you how.

Foremost of all, know your average monthly SSS contribution. If you are an employee, you can ask the HR or accounting of your company or you can look at your payslip. If you are self-paying, I guess you know how much you are paying.

Below is the SSS Contribution schedule updated for 2014, which estimates your total monthly contribution and employer’s contribution.

In the table above, note the following:

ER column – is your employer’s contribution

EE column – is your monthly contribution.

AMSC – you can see that in the second column of the SSS table. It is the average monthly salary credit. This will be applied in calculating your monthly pension.

Now, let us compute for the maximum pension you can receive.

Let us suppose you are receiving an average of P 16,000 monthly salary with 12 years of service.

From the range of compensation, you are in the ( see table 15,750 – over), your employer’s contribution will be P 1,208.70 and your contribution is P 581.30, for a grand total of P 1,790.00.

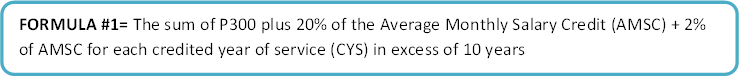

Based on SSS computation, there are three formulas which we can use in calculating your monthly pension. The pension will be based on the highest computation from the 3 formulas.

Monthly Pension (MP) = P300 + (20% of AMSC first 10years) + (2% of AMSC 2 years)

Monthly Pension (MP) = P300 + (20% of AMSC first 10years) + (2% of AMSC 2 years)

MP = P300 + (20%*16,000) + (2% *16, 000* 2)

MP = 300 + 3,200 + 640

Monthly Pension = P 4,140

Since you are a contributor for 12 years.

Since you are a contributor for 12 years.

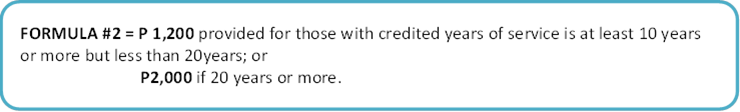

Monthly Pension = P 1,200.00

MP = 40% of 16,000

MP = 6,400

Monthly Pension = P 6,400.00

Based on above computations, the 3rd formula yields the highest monthly pension (P 6,400). Your monthly pension will be based on this amount.

Summary:

- Computed above is the maximum monthly pension you can be able to receive for a 12 years contribution. If you are earning more than 16,000/month, it does not matter. It will have the same computation unless they raise the AMSC in the future.

- You cannot have a monthly pension unless you have given a minimum of 10 years or 120 months total contribution.

- If you are self-employed, you can still contribute on your own. You decide on which salary credit you want. Better get the maximum or P 1,790 pesos per month of voluntary contribution to get the maximum benefit.

- If you want to retire comfortably, you should have to own a private plan. Carefully guided and computed by a financial planner or financial adviser. This will be computed based on your future wants and necessities against annual inflation rate.

To answer the question from the title above, is your SSS retirement benefits enough for your retirement needs? After reading above and computing on your own, it is for me to ask and for you to answer.

Let me rephrase the question, “If you are to retire today (imagine you are already old right now), would P6,400 be enough for you now? How much do you need to survive today?” Consider your house, food, electricity, water, maintenance medications and other health concerns. Then answer the question.

If the answer is no, want to know how to retire comfortably? Plan your future now. Now that you still have the money. Start saving for the rainy days!

Click here to know more about the Retirement series on this blog!

The Filipino Retirement Scenario, Find Out Where will you Belong in the Future

How much should you be saving for Retirement? Do you have what it takes to retire comfortably?

Contact me if you want to have your very own personal plan.

It’s time to compute your own pension here. Subscribe to download your own SSS Pension Calculator here:

Disclaimer: The above computations are based only on research and careful interpretation of the writer. You can visit and consult any SSS branch near you for any individual concerns regarding your SSS retirement benefits.

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

I’ve been looking for ds computation so I could put it on my blog…hahaha..

thanks for articulating..:)

My thoughts:

Problem: By the time you retire, Social Security will not provide for your retirement. It was designed as a supplement to retirement income, not as a primary income.

Solution: Start investing money to fund for your retirement. Never depend to someone else for your financial future – no one cares about your future the way you do.

Nice

thank you

Hi sa formula #1 ung sum po ba na 300 is sa lahat ng computation of the monthly salary credit? For example: the sum of 300 + (20%×1000)+(2%×1000×2)

kindly download the excel file. So that you don’t need to compute anymore. Just encode the data.

Kindly guide us where to find the excel file; and how to download it (are there special instructions kagaya ng sa ibang website na madaming specifications before magwork yung downloaded file/program).

Got the excel file I’ve been looking for (attached in the email you sent me after I’ve reregistered).

Thank you very much!

I tried the excel file attached in your email, computing the estimated retirement benefits:

at Max. cont. of P16k for 10years, umabot ng P6,400.00 monthly pension; then pagka umabot ng 20years same P16k salary range eh P6,700.00 monthly pension lang? difference of P300 lang, Tama ba?

20yrs contributing to SSS will receive P6,700 only vs. P6,400 monthly pension ng member who contributed for 10yrs only? Tama ba yon? Parang di naman ata makatarungan kung ganun nga 🙁

Buti pa ang Pag-IBIG, kung magkano ang naicontribute ng empleyado, plus yung employer share, after 240 months of contributions kahit wala pa sa retirement age, makukuha lahat yon ng empleyado at mayroon pang dagdag na dividend na di hamak na mas malaki kumpara sa interes na binibigay ng banks at maganda pa noon, tax exempt ang earnings dun, mapapakinabangan talaga pagdating ng tamang panahon!

just my thought.

Well, there are other benefits that sss can also give. So you also have to take in consideration those things.

Read here to be informed of other benefits:

http://www.myfinancemd.com/dissecting-social-security-system-sss-it-pays-to-know-your-rights-and-benefits/

Very informative article.. i didn’t know na ganito lang pala kaliit makukuha sa sss retirement

What is the age limit require covered of this pension?

as long as you have contributed for 120 mos or 10 years and you reach 60 years old.

Hello po, tanong lang. If naka contribute ka na more than 120 months, pwede na bang mag stop? kahit na 35 years old ka pa lang. tapos if pwede ka ring mag file ng pension at the age of 60 kahit nag stop ka na by the age of 35 pero umabot ka sa 120 contri. Salamat sa reply.

yes, pwede basta you reached the 120 months contribution. Although mas malaki makukuha mo if you contributed more as per the formula in the article. You can file na at age 60, yes.

Based on my gut instinct computation, there is a big diminishing return of investment for each peso contributed after the 120th month.

You should put your money elsewhere.

Yup, right! You should put it in place where compounding is good. Like stocks, mutual funds, life insurance… etc

I’d like to know more about this..pls send contact details pls..thanks..

http://www.myfinancemd.com/contact-me/

Hi! Just a question.

In the summary you stated:

2. You cannot have a monthly pension unless you have given a minimum of 10 years or 120 months total contribution.

Does it have to be 120 months of total continuous contribution. What if I have worked for 3 years then stopped payment for 10 years then resumed payment through voluntary on the remaining 7 years. Will I still get my pension? 🙂

Thanks!

that’s ok, as long as the total is 120 mos or 10 years.

Hi! Would it be wise for me to continue my sss contributions (i have only 19 contributions) to complete the 120 as required to qualify for the pension? I am already 57 and a voluntary sss member. So, i have to complete my 120 maybe at age 65. I understand that i can no longer jump to the maximum contribution because i am over 55 already and at most, i can only contribute up to 1330 a month considering a yearly increase in contribution. How much do you think will then be my pension? Is it worth my take to continue contributing? Considering a 2 to 4% inflation rate? Your response will be greatly appreciated po. Thanks a lot!

Since you only have 19 months to go to complete. I think it is wise to really just contribute to complete. Contribute the highest contribution you can. They will base the computation of your pension with the average contribution of the last 5 years of what you gave.

What if you exceed the 120 month contribution? Will it be the same computation? Thanks

hi alex, in the formula, if you exceed 10 years paying, there is additional. look closely in the computation. The example was at 120 months + 24 more months. look at the effect. 🙂

good!

ok

Im NOT contented on the SSS Benefits.. as of now im not recieving my pension im already 63 yrs old.

Im a former employee of MKWD from Feb 1977 to Feb 1988. 11 yrs of remetting my contribution but because of Transfer of remittance to GSIS last 1992.. they also include my remittance even im already retire in the office..so when i follow up my retirement.. SSS told me i have no more remittance in thier office.. i ask why where is my my money where im remitted ..ias if im a Basketball.. they dribble and pass to GSIS.. Im tired on following.. so to SSS members be carefuull they are Falling us . talking their nice benefits of the members but its not true…

question: what is the computation if the ofw pays more than the 120months? like for example for my father who is a seaman for more than 20yrs who has a total 176 maximum contributions as of june 2014? thanks in advance!

I’m 53 years old now and I stopped working already. I have a total contribution of 23 years (276 contribution). All my contributions are in are maximum bracket.

Since I don’t have a regular income anymore, I cannot continue paying my SSS contribution until I reach 60 years old.

My question is, when I reach 60 (hopefully, prayerfully), will I still get P7,660.00 as monthly retirement benefit based on Formula 1?

P300 + (20% of 16,000.00) + (2% of 16, 000.00 for 13 years)

or

P300.00 + P3,200.00 + P4,160

or

P7,660.00

T-I-A

Hi Butch, yes. the formula that will yield the highest result. If, regulations won’t change until you are age 60. Since future regulations will do apply. That will do as of the moment. 🙂

I’m 54 yrs old and I avail of company’s early retirement last 2003.

My total contribution was 239 months(Almost 20yrs).

My contributions are in maximum bracket base on

SSS contribution table year 2003 which is PHP1410 with MSC of 15000.

Here’s the problem, Base on the SSS contribution table for 2014 the PHP1410 made last 2003

will fall on MSC of 13500.

I stopped paying my SSS contribution last September 2003.

When I reach the age of 60, which MSC will be the basis for calculation ?

Based of 2003 Table: P300 + (20% of 16,000.00) + (2% of 16, 000.00 for 10 years)

P6275

Based on 2014 Table: P300 + (20% of 13,500.00) + (2% of 13, 500.00 for 10 years)

P5677.5

Difference of P597.5

hi, download the SSS calculator for easier computation: http://www.myfinancemd.com/how-to-compute-your-sss-retirement-pension/

Hi! My quiry is for a friend whom SSS denied pension til 2017 due to a loan that she didn’t actually applied for. Accordingly, someone else did the loan under her name. She is now 60 y/o, but still working hard as an employee in a clinic coz her small salary is all she has to support herself. What should she do to claim what is due for her? Thank you in advance.

Hi liz, She need to prove to SSS that it is not her. I guess you need a legal consult with this one.

I have questi.my father in law have a total contribution 277 months how much will he get in his retirement.?.tnx

that depends on how much is he contributing in the last 5 years.

Good day ma’am,

My mom was already 55 y/o when i started paying her sss contibution. As mentioned above, the client must pay for a minimum of 10yrs. Therefore, eventhough she will reach the age of retirement (60y/o) she won’t be able have her pension? Is it still advisable to continue paying to reach the min. of 10yrs requirement?

Thank you.

hi, requirement is at least 120 months. or 10 years, that would be up to her age 65.

she will not qualify for the monthly pension but she will get all her contributions + interest as a lumpsum payment.

Tanong ko lang po ang father in law ko. His SSS contribution is 277 months.so how much his monthly pension?

hi, depend on how much he is contributing in the last 5 years.

P300 it is common on formula 1? Or it will change it depends on your contribution?

It’s constant

It’s constant formula

Hi finance md,

I have question regarding my contribution. When I was working, my sss contribution was P1500+/-. When I became an ofw, I continued my contribution, but I only share P1100 now. I already made 125 contribution.

So, my question is, since I already made the 120 contribution required, is it still necessary to keep sharing since the effect in option 1 is only minimal?

What if I continue my contribution but cut it in half P550, is there any effect (bad or good) or its just a waste?

Thank you!

Follow-up question,

I just want to know what if I have different contribution bracket (ex. 800, 1000, 1200, 1500), how would they compute my final AMSC?

I believe I should stop my contribution now as I’m on voluntary share and maybe it won’ t be a big impact on my pension in the end. It may be better to save those money and invest in something. Any advice would be appreciated. Thank you.

Hi, it would have different computations in the end. Depends on the contribution bracket you were in. Just make sure you already contributed 120months before you stop contributing

Well, extended years of contributions also have effect. But personally, I think you are right, it is only minimal. If I’m in your position I will invest nalang elsewhere where interests are high. Just make sure you are in the right investment depending on your needs and wants.

I’ve worked for 15 years and stopped to be a full time mom. For the past 15 years, I’m under the maximum AMSC bracket. To maximize my pension benefit, I plan to continue paying my SSS. Do I need to pay the max contribution or just pay the minimum and switch to maximum contribution at a later time? ie. when Im near age 60?

How to compute if the bracket of your contribution has changed?

Ie. Year 1 to 15 = max contribution

Year 16 to 30 = min contribution

Year 30 to 40 = max contribution

Thanks 🙂

You just pay max contributions if you like higher pension. Or you can also consider investing elsewhere (stocks, Vul or mutual fund) if you really want a more comfortable retirement fund in the future.

Thank you for your advice, got it now 🙂

Isn’t it that there are rules that you can’t go from one bracket to another within a year? For instance, you’re not allowed to pay max of P1760 then down to min of P110 within the same year?

Yes, there is such rule. The upgrade or downgrade should be gradual.

Hi Jaimie, Based on the formula provided by SSS, the calculation will be based on the average monthly salary credits which is calculated from the last 60 months of your contribution salary credits divided by 60. Therefore, you can basically, contribute the minimum amount and then bump it up to the max 5 years before retirement then you still get the maximum salary credit when SSS calculates your monthly pension.

Thanks for your quick response Dra.Pinky. And yes, I finally stopped my voluntary contribution and bought some stocks. I believe it would give me higher yield in the end. Thanks again finance MD.

No worries. Happy to help.

Hello, what happens if you contributed different amounts each month?

How will the pension be calculated?

It will be calculated also differently.

I want to continue my payment because I stopped when I go to Dubai. So what will I do to continue again?

Please guide me the procedures.

Thank you,

Mary

Hi are you in Dubai right now? Because if you are here naman, you can go to the nearest SSS then they will guide you there naman.

You can ask your family member to pay your sss contribution in the Philippines just like what I did or you can pay to UAE Exchange and Al Ansari Exchange.

You discussed only up to 240 contribution. What about those more than 240+? I have more than 240 and at max contribution, how can i know my pension. You suggested that go for the max, but you also mentioned that return after 120 is not that worth much. Your reply for the 2 question is much appreciated.

The sample computation is already in the max. If your salary is more than 16,000, it will be computed on the max computation already. The computation vary if you have more than 120months contribution. Just follow the computation above for more than 120months contribution.

Hi. I’m 53 years old and I plan to start contributing to SSS. Should I pay the maximum contribution now until the age 63 or can I just pay the minimum voluntary contribution for the first 5 years then increase it to the maximum for the remaining 5 years. I need your advise please. Thanks.

Better to start the highest contributions you can afford since, we do not know what the future holds. SSS don’t only give retirement benefits but also, sickness, loans, etc. It is better to contribute the highest you can afford since every benefits will be computed based on your contributions.

My retirement not yet received. File on march 19, 2015. Ngayon pending pa. Maam/sir d man k nakafile ng SSS ko sa Davao. Napaconcelled ko na yun.. Salamat

Hi po. Follow up nyo lang po. Di kasi ako taga SSS kaya i can’t answer for them. Try to follow up once in a while.

Hi,

For example, I already contributed 120 months with 550/month min. contribution therefore a 5,000 AMSC (2006-2015). But then I stopped til Dec of this year.

How about if continue in year 2020 for another 5 years (2020 to 2024) with 550/month min. contribution. What will be my AMSC? Is it 5000/15yr or 15000/20yr? Will the 5 year gap of not contribution included in computation of AMSC?

Likewise, if I only contribute 120 months of min 550 and then I reach 60. I start contributing at age 26. Will the AMSC computed ast 5000/10yr or 5,000/34?

Thank you.

Regards,

Dj

It would be 5000/15yr. The gap won’t be included in the computation. The longer you contribute the higher the pension you are going to have. Since one of the computation is total of years contributed.

I been an SSS member since 1981 and been regularly paying my monthly contribution. I’m already paying the maximum monthly contribution under the maximum salary bracket. I’m 54 years old now.

I would like to know how much will be my monthly pension upon my retirement 6 years from now. Hoping for your immedaite response. Thank you and God bless.

Hi po, as per my computation if you are going to retire by year 2021, then it is more or less 13,100per month. Kindly check the computation in the article. Thanks

My sister is now 67 years old and living in the U.S. since 30+ years ago. She had only 108 contributions to SSS during the time she was working in the Philippines. Can she still continue to make 12 payments to complete the requirement of total 120 contributions to claim monthly benefits?

yes she still can.

clear ko lang po kapg 120months yung contribution yun lang pwede magclaim ng retirement program?

what if less than lang siya anung pwede niya ma claim?

or maibabalik po ba yung mga naihulog niya before?

hi, if contribution is less than 120 months, you will get a lump sum retirement benefit and not the pension benefit. You can have yours computed at SSS office.

Hi!

My mom is 58 years old and has a total of 45 months contributions. Can she voluntary pay to complete her 120 months so that she will be eligible for her pension.

Thanks.

Yes Roselyn.

You can report it to media mam.Isn't joke,,but if you stay silent many will suffer as well.There should be a clear investigation of it.Its your money fight for your right..

Hi, Dra. Pinky.

Just want to ask, in the formula #1.. where did the 300 come from?

How about in the formula #2, where did the 1200 come from?

How about in the formula #3, where did the 40% come from?

Thank you!

Hi Rea, all are default formulas given by SSS. You can look at it from SSS website. Basically it’s this: P1,200 if they contributed between 10-20 years. If they’ve reached 20 years or more, then they’d get a minimum P2,400. The second formula is 40% of their monthly salary credit and for the third formula, it is P300 plus 2% of every year the contribution that they make. So there are 3 basic formulas, in whichever is the highest of the formula is the pension benefit given to the individual. As to where they derived the formula, we don’t know for sure. 🙂

Hi Pinky!

Thank you for this great article. Everything is well-articulated and SSS should put some further explanation like the example provided in the article. I have some clarifications with regards to self-employed individuals. You have suggested that we opt to get the maximum Php 1790/month contribution. Let’s say i still have 30years ahead of me before I retire. If I chose to pay a lower contribution for the next 20 years (Php 500+/month) and decide to pay for maximum for the last 10years (Php 1790/month). Will i still be qualified for the maximum benefit which is Php 13,100 based on Formula #1? Hope to get your thoughts about this. Thanks in advance.

Hi Rachel, ok sana but SSS has a rule na di allowed yung jump from a low contributions to highest contributions in a span of a year. Dapat gradual yung pag akyat ng contributions in a span of years.

Hi. May I know if the compoutation of the AMSC is the Total Amount of Contributions over the Total Number of Contributions? Originally, I worked in the Philippines, then later on, became an OFW. Naturally, my previous contribution is

much smaller compared to my current contribution which is the maximum. Will I get the P16,000 AMSC computation? Thanks

AMSC is computed based on how much you are contributing. How much are you contributing before you became an ofw and now that you are an ofw? If you do not know, we will not be able to know your AMSC. Which will be used in computation of your retirement pension or lump sum benefit.

Thanks for the reply. From 1976 to 1996, I was working with different employers, some of whom did not remit my contribution. Around 50 contributions haave been recorded. I was employed from 1997 to 2006 in a government firm.

Starting 2007, I religously pay the maximum contributions since I am an OFW already. I have already 180 contributions. Is there a need for me to continue paying my contribution . It seems it would be a waste of money since it will not increase

my pension until I reach the 240 contribution, with a difference of P300. Since my 50 contributions are very minimal, thus affecting my AMSC, will it be included in the computation of the AMSC. I have been paying my contributions

for around 8 years with the maximum amount while 6 years of a minimal contribution. Thanks.

Hi Armando, the computation of your pension will be based on the AMSC of the last 60months of your contribution. Your pension can still increase based on the number of years you have contributed.

Total amount of my contribution is P196,400 with 180 contyribution. Does the computation be 196400 / 180 = 1091 or an AMSC of P10,000 or P4,000 OR I will be receiving P6,400 as I have been paying the maximum contribution

for the past 8 years. Thanks again.

Thank you so much Dr. De Leon for the fruitful information.

Thank you too for reading. If you have further questions don’t hesitate to use the contact page. 🙂

Dear Ms. Pinky,

I have been contributing to SSS since 1981 until this date. I am already 54 years old. Can you give me an estimated amount of my pension once I decided to retire at the age of 60 which is about 6 years from now.

Hoping for your favorable response soonest.

hi Mr. Renato, I need to know how much are you contributing monthly since you started. The pension will be based on the contributions. email me: myfinancemd@gmail.com

Hi Ms. Pinky,

I’m paying monthly contribution to SSS the maximum contribution rate. I m a member of SSS since 1981. Iam already 54 years old and soon to retire 6 years from now. Can you please compute my monthly pension from SSS.

Thank you and warm regards.

Will you continue paying for this last 6 years? Para i can i include sa computation.

Hi Ms. Pinky,

Yes i will continue paying my SSS contribution while still employed until my retirement age.

Ok po, i will email it po sa inyo later. 🙂

hi sir, this is not the exact pension you are going to get, because there may be future changes that may affect the computation, but as of today. here it is;

FORMULA 1

AMSC 16,000

Constant 300

20% of first 10years 3,200

2% of excess 9,600

Excess years (>10) 30

Year Retiring 2021

Years started 1981

13,100 (your monthly pension), approximately if nothing will change with their policies and formula.

i also sent the details in your email. i hope that helps.

Ms. Pinky,

Thank you for your immediate response to my query.

Will there be any difference in the amount and computation if I will stop paying my SSS contribution now? Will it be allowed by SSS if I stop paying even though I’m still employed? Hoping for your usual prompt attention and response.

If you are employed they deduct it automatically. But you are self employed you can opt to stop since you have already contributed for more than 120mos. If you stop paying now your pension will be around 11,180/ month. I instead of the earlier computation I gave you. 🙂

Ms. Pinky,

Thank you for your time and immediate response to my question. God bless.

and here comes the inflation..how much is 6400 by that time..😁 nice illustration Ms. Pinky..I am a neophyte in financial advicing and this would help a lot..Kudos!

you can get the future value and apply 4-6% inflation rate. 🙂 Kulang na kulang talaga. 🙂

Yung “years of service’ po ba ay tumutukoy sa total number of monthly remittance? halimbawa, 120 monthly remittance is equal to 10 years of service po ba? kse pwdng kht 10 years kang employed ay hnd parin aabot ang remittance mo ng 120 months like ung mga seasonal employees.

Isa pa pong tanong, halimbawa may total remittance kang 396 months. dba 120 months lang ay eligible kna to receive pension? ano po ang mangyayari sa excess monthly remittance na 276 months? yan po ba ay masama dun sa computation ng marereceive mong monthly pension? Or ibabalik ng SSS sa pensioner as lump sum payment at the time of retirement?

Marami pong salamat at napakalaki po ng tulong ng post mo na ito. God bless po!

Yes, yung years of service is the total number of remittance. If sobra sa 120months, there is additional pension. As stated in the formula. If you look more closely sa formulas, there is one formula there that includes the months in excess of 120mos.

Will SSS accept an early filing of retirement pension 6 months before retirement date? Thanks.

Hi you can ask the local SSS branch you will file into. They can decide if they will allow it or not. as long as you already have contributed 120 months.

HI!

Kung 62 years old na po yong edad as of present and then 2 months lang yong contributions tapos babayaran in full yong 118 months to complete the 120 months to avail the pension pwede po ba?

Naku di ata pwede Jella. Kasi, supposedly its 10 years contribution and the computation of the pension will be based on the last 5 years of contribution.

Hello My Finance MD

I’m 27 years old and I’m planning to start my sss contribution this year a a voluntary member. i will start at 5, 000 salary bracket and probably every 2 years i will increase until I reach the 16,000 bracket before i reach the age of 55. i want to have a 10,860 maximum pension at the age of my retirement. my question is. ” is this a good Strategy for me? ” or”If i will start may contribution at the lowest bracket it will affect may pension?”

Thank you very much

That’s fine if pension Lang Yung habol mo. Since the last 5 years will be used in the computation of pension. But if you are also after the other benefits, those are also be based on your current contribution.

That’s fine if pension Lang Yung habol mo. Since the last 5 years will be used in the computation of pension.

Mam Pinky De Leon, MD, RFC

I am paying a monthly contribution of P1,760.00. An SSS members since 1981. I am now 55 years old. I would like to know how much will be my monthly pension when I retire 5 years from now at 60 years old.

Hoping for your prompt and favorable response soon.

God bless

Rene B. Pacheco

thanks for enlightening us… i need to know this since I’m paying as an self-employed na from being a an full time employee.

I’ll study it first, but it’s good that Filipinos should think of their retirement.

doc, theoretical question/situation po … assuming MAX lahat (except the constants, of course) what would be the MAX pension from SSS?

let’s just assume that MAX means … Salary of 200,000 a month, and years of service of, uhm, 45 years … and yes, 200,000 per month sya for all of those 45 years … what would be the monthly pension from SSS?

would the figure significantly change, say the salary is 400,000 monthly?

would the figure significantly change, say the contribution is monthly for 55 years?

curious lang po, kasi sa GSIS, if you had more than 36 years, your pension is 90% of your last 3-yrs salary average …

still, the same computation applies. you can download the free SSS calculator in my website, and you can experiment for the computation. 🙂 subscribe in my blog and you will receive the calculator in your email.

hi doc

will be retiring this june. completed the 120 monthly contributions (137 actually). i worked for at least 3 years with the last employer and there is a difference in the monthly contributions from the previous employer , which is lower…how will they (sss) calculate the monthly pension? ty.

They will based it on your contribution on the last 5 years before you retire. 🙂

Hello Doc,

I’m a seaman 59 yrs old over 120 months na po ang contribution ko since 1995. Ask ko po sana kung puede ako mag lump sum and how much?at ilan working days bago makuha.

Thanks a lot.

you can only avail if 60 ka na. And yes you can avail of the lump sum but i suggest you get the pension instead. Mas maliit makukuha mo sa lump sum vs pension.

Greetings po Ma’am Pinky,

Ask ko lang po kung yung local employer lang po ba ang dapat i-declare or pati po ba yung foreign employer?

Thanks po.

Hi, para saan po? For SSS? As long as you are contributing for SSS, counted yung years na yun kahit nasa ibang bansa po kayo.

If one is contributing to SSS through salary deduction made by employer, di pwede mag stop as long as you’re employed (up to the age of 60/65), the employer has to withhold your contributions from your salary and the employer actually shoulders a higher amount (for example the max cont. at present EE=P581.30 while the employER= P1,178.70 plus P30 EC) at mas lalaki nga ang makukuha after you’ve contributed more.

Let me reply to this.

Local employers as well as foreign employers operating and maintaining office in the Philippines and employing local staff are required to register with SSS and w/hold employees’ contributions and pay/remit the employer and employees’ shares to SSS on a monthly basis.

Hi ask ko lang po kung manirahan ako for good sa ibang bansa and i do want to get all my contributions sa sss pwde po ba kahit hindi pa ako 60 years old and i did reach the more than 120 months contributions thank you

Hi Anna, they require you to be at least 60 years old to be able to avail.

Hi my father applied for retirement benefit at age 63 in March 2016. He got a lump sum of the first 18 months.. When would he receive his 19th monthly pension? Upon checking online I noticed 2 entries for a 13th month dated 2014 and 2015. What does that mean?

It would be more appropriate if you ask directly the SSS. Their hotline is: NCR 920-6446 – 55, Provincial hotline 1-800-10-2255777, they are open monday- friday /24 hours. If you like to get your call through, for less busier lines call them at night or or wee hours of the morning.

Good afternoon,

I am 64 years old and just recently I asked my wife to apply for SS retirement benefit for me, although they did not allow it as they said that I have to personally apply myself (I live abroad), the SS employee said that aside from the monthly pension, I will receive a lump sum payment for the 4 years counting from the age 60 when I first started to qualify for benefits to age 64. Is this correct?

Thank you in advance for your reply.

That, I didn’t know. but I will try to ask and update you as soon as i get their reply.

If you want to call them, i saw this Toll free hot line of SSS for OFWs: https://www.sss.gov.ph/sss/appmanager/viewArticle.jsp?page=NR2015_105

Hi

if you fail to pay your

personal contribution for kids for future pension retirement

is there any penalty involved?

what happen if you pay your sss and then suddenly for a period cant pay it?

Please i need information in this matter

What do you mean for kids? You only pay for yourself. If you stop paying. You can just continue paying.

Can i continue paying, start whenever i get a new job again? (its my asawa that is in Dubai that asks and she have Heard from some friend some strange things) i must verify some of it, I cant find it in the text from sss.

You can continue paying even if there’s a gap. They will have a record naman you can take a look.

Thank you

If I am currently contributing minimum amt as voluntary to Sss will increasing it to maximum amount at age 55 maximize my retirement benefit? Does the increase have to be gradual? Or can i just jack it up at age 55?

They said the computation of the retirement pension will depend on the last 5 years of contribution, but this may change in time if they change their regulation. What you are doing might work but as I said, it can change. You need to watch out of new regulations.