Many Filipinos shy away from life insurances. I don’t exactly know why, since I know many benefits it can possibly provide. Maybe most Filipinos are still trapped from the old mentality that, “I don’t need money when I am dead” knowing that life insurance proceeds are given only when the owner of the policy dies.

Many Filipinos shy away from life insurances. I don’t exactly know why, since I know many benefits it can possibly provide. Maybe most Filipinos are still trapped from the old mentality that, “I don’t need money when I am dead” knowing that life insurance proceeds are given only when the owner of the policy dies.

Well, those were the old life insurance policies. Today, life insurance policies evolved from giving only death benefits to providing “living benefits” to the policy owners, while they are still alive. But many still do not understand what they can do with their life insurance policies.

And these are:

Do you know that, with your Permanent Life Insurance Polices you can be able to:

1. Loan

In Filipino, “Utang.” Do you know that you can loan to the cash values of your insurance policies depending on the insurance company’s bylaws. It is usually up to 85% of the cash value at a minimal interest rate (8%/year) which is way below the interest rates in banks which is usually 13-20%/year. And you have the option when you want to pay, as long as the policy is still enforced, and you don’t mind the interest. In simpler terms, “pay when able.” How cool is that?

2. Withdraw

Depending on what type of permanent insurance policy, you have, you can withdraw the dividends on your traditional insurance policies or fund values of your variable life policies. You can even use the withdrawn amount in paying your next premium dues granting that the amount is sufficient to pay for the premium.

3. Use Insurance Policies as housing loan requirement

If you are buying a house and lot, and you need to loan from a bank. The bank will ask from you a so- called “MRI” or Mortgage Redemption Insurance, which means, as a primary loaner, you are required to insure yourself the same amount of loan you have in the bank. For example, you loan a 2 Million house and lot, you should have an insurance policy which has a face amount of 2 Million pesos. This is needed so that, in case of the loaner’s demise/death while there is still loan, the insurance company will be the one to pay the remaining loan to the bank.

4. Get your baby insurance at 2 weeks of age

Many parents are not open in insuring their babies. But do you know that, 1 out 5 children become uninsurable at age 18 years old? Meaning, they can never be approved by an insurance policy later in life?

Factors to consider here are: Congenital disorders which are usually are diagnosed toddler to pre-school age, child obesity due to lifestyle, and some unforeseen things that can happen.

5. Use it to channel your legacy even if you don’t have money right now

Let’s admit it, life insurance is “Instant money” once a policyholder dies. Even if you don’t really have the money right now that you can proudly say you can leave your family, a life insurance money can help you leave a legacy to your loved ones. As they say, why die for free?

6. Use it as payment of “Estate Taxes”

As we accumulate wealth when we are alive, they are being called as “Assets” but once we die, those assets will be called “Estate.” In order to have a proper transfer of your estates to your descendants or children, your heirs need money for proper settlement of the Estate Taxes. Life insurance can play a major role now and can function as “Wealth Protector.” This will be further discussed in the next coming post.

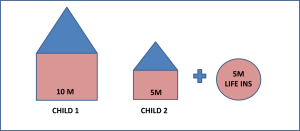

7. To equalize inheritance of heirs

Let’s say you have two houses and two children. One house is worth 10M, the other house is worth 5M. To avoid disputes or jealousy between the two heirs and to prevent liquidating the bigger house just to equalize values of inheritance. Just buy an insurance policy equivalent to the difference of the two properties.

8. Insure your employees and even your “kasambahay” and even use it for their retirement benefits

As an employer, we are liable for anything that might happen to our employees during the time they are working for us. Having them insured, can give us peace of mind that if anything goes wrong. You can have something that you can give to their families just in case. Your finances will not be drained since the insurance companies are the one that needs to compensate.

As for retirement benefits, if you have loyal employees and stayed with you until retirement, you are entitled to give a retirement benefit once they reach the age of retirement, which is equal to ½ month of their salary times the number of years at work. If early on, you have saved for them, you won’t be burdened to give a big lump sum amount when the time comes since their life insurance policies will take care of that.

9. Attach Critical Illness rider in case of a critical illness

Have you heard of a friend or a relative who was just recently diagnosed with cancer at a very early age? If it can happen to them, maybe it can happen also to you. Better to be sure than sorry. A lump sum of 1 Million pesos or more is not bad if you are suddenly diagnosed with a critical illness like: Stroke, Heart Attack or Cancer. It may even save your life.

10. Surrender your policy and get the current cash values or fund values

If all else fails and you need money so badly and nobody would help you out. You can still get money from your insurance policy. Of course, this would be your last option. You can surrender your existing policy in exchange of money (the present cash value/fund value) at the time you want to surrender your policy.

Those are the ten things you may not know your life insurance policies are capable of. There are million of reasons why you need to have one. There is only one reason that is stopping you from getting one. And that is Ignorance. I hope by the time you are educated enough and ready enough to get one, I hope it’s not too late. We just live a borrowed life. Anytime, the Life that was given to us will be taken away. Be sure, at least you won’t burden those you will leave behind.

More Good Reads:

12 Terms you need to know before buying a LIFE INSURANCE

TERM Life insurance, the Cheapest Life insurance Ever!

The Top 10 Life Insurance Companies in the Philippines The Most Updated and Most Unbiased Review

You have more questions? Contact me here.

Want more of these? Subscribe here for free.

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Hi Dra Pinky…thank you for the post…

Which of the insurance company offer all of the above?

And which of them gives the best offer? Thanks 😊

as I always tell, all insurance companies present products that are more or less the same, what you should be more concerned of is, who advises you.

Here is a guide on how to choose the right adviser for you: 5 Insider Tips on Finding the Right Insurance Agent/Financial Advisor For You http://www.myfinancemd.com/5-insider-tips-on-finding-the-right-insurance-agentfinancial-advisor-for-you/