“A life Insurance saved my life.” I heard once from a testimonial speaker.

“A life Insurance saved my life.” I heard once from a testimonial speaker.

This is a TRUE STORY of Juvy (not her real name):

Juvy – 35 years old diagnosed with Cancer, got his policy when she was 30.

She owns an insurance policy with Face amount: 1M

With life insurance riders of: Critical Illness rider: 500,000 and Total disability waiver.

Upon diagnosis of her BREAST CANCER, she received a lump sum of: 500,000. She used the money for her operation and medication.

Gone are the days when a LIFE INSURANCE policy is only used when the policy holder dies. There are numerous LIVING BENEFITS you can get from a life insurance. And with that, you are going to need a rider.

Living Benefits – from the word itself. The benefits you can get while you are still alive.

What are Life Insurance Riders?

Life Insurance Riders – are additional features you can add to your basic life insurance benefits. This entails additional cost for the additional benefits.

Riders with Living Benefits

1. Critical Illness Rider – this is an important rider because it forms one of the LIVING BENEFITS. If the policy holder is diagnosed with any pre-specified DREAD DISEASE like Myocardial Infarction (Heart Attack), Stroke or Cancer, the policy holder will receive a lump sum, may be equal to the policy’s face amount or a percentage of the face amount. The insurance will remain enforced.

This is the story of Juvy above.

2. Hospital Income Benefit – When we get sick and gets hospitalized, we lose our income because of being absent. This rider provides daily income benefit while we are in the hospital.

This is usually computed in percentage of the face amount of the insurance policy. And since we are assuming we work only up to 65 (age of retirement), this benefit is only given up to age 65.

This benefit usually doubles if sickness is due to a dread disease and triples if insured is admitted in ICU.

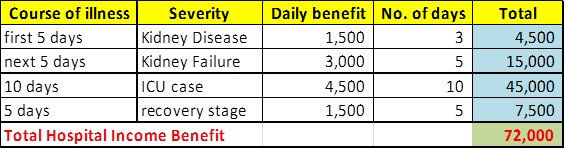

- Eg. Jayce is 35 years old insurance policy holder, covered at 500,000 face amount with Hospital Income benefit rider for 1,500/day

- He was hospitalized due to Kidney disease at age 40, for 5 days in a regular room.

- His condition had a complication and became worse due to Kidney failure and eventually had Kidney dialysis for the next 5 days.

- After 5 days, since condition gotten even worse, he was eventually transferred to the ICU in the next 10 days. Thankfully, he became better and taken back to a regular room for 5 days recovery.

How much will he get?

The total benefit in this (1) course of illness is 72,000, which will be given to the policy holder after the required papers are submitted. This will be more of reimbursement type. This will not affect any benefit from PHILHEALTH nor other HMO of the policy holder.

3. Total Disability Waiver – this is an important rider. Since we may never know what will happen to us, in case of permanent disability (you cannot work due to disability for 6 month minimum). The premium will be waived. The insurance company will assume over the payment.

Remember Christopher Reeve? Superman of 1978, he became Quadriplegic at age 43 due to a horse riding accident for 9 years before he passed away at age 52.

Quadriplegic means he cannot move his body, he was paralyzed from the neck and down. He even requires breathing apparatus since his diaphragm was also paralyzed.

The point here is, even superman gets paralyzed. We cannot predict what will happen to us? What if, we are just ordinary Juan who have 3 kids and a housewife to support?

4. Comprehensive Accident Insurance – this is rider that gives LIVING BENEFITS as well as additional death benefits. Provides for death, dismemberment, disability, and hospitalization resulting from accidents.

Any injury/hospitalization that was incurred due to an accident, a percentage of the face amount will be given to the Insured, depending on the body part. Usually a percentage of the face amount is predetermined benefit depending of the body part that lost its function as a result of an accident.

Eg. TRUE STORY:

- Matt, 23 year old accountant use motorcycle in going to work, he is insured with 500,000 face amount with the comprehensive accident insurance for 500,000

- At age 25, during a motorcycle ride, a car suddenly hit him and his right eye was injured, due to that accident, his right eye became BLIND.

The insurance company gave him 50% of the face amount which is 250,000 (1 eye).

Riders with Intensified Benefits (Additional Death Benefits to beneficiaries)

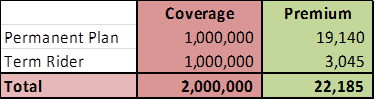

5. Term Rider – Provides term insurance coverage during the coverage period, which is the same as the base policy, or up to attained age 70, whichever is earlier. Premiums are level. This is usually added if you like a higher insurance coverage.

- eg. Marie Jane is 38 year old single mom, she wants a permanent plan but wants a higher insurance coverage because she is a sole bread winner of her family and has a 2 year old daughter.

- She got 1M coverage from a permanent plan then gets a rider of additional 1M as a term rider with just a litter additional premium.

6. Accidental Death Benefit – this doubles the coverage when the policy owner dies due to accident.

- E.g. Dado – 40 years old, dies due to Vehicular Accident (policy holder of an insurance policy with face amount of 500,000 and also with Accidental Death Benefit as a rider)

- Beneficiaries will receive 1M worth of insurance instead of only 500,000.

7. Payor’s Benefit – this is also an important rider, especially if the insurance policy is intended for a minor (for purposes of education plan, et.al.)

- E.g. TRUE STORY: Mommy Linda is a sole breadwinner and a single mom to Baby Jay, she is 23 years old, baby is 2.

- Mommy Linda got an insurance policy with investment for Baby Jay intended for his education. Unfortunately, at age 26, mommy Linda died due to an accident.

Baby Jay’s policy will continue. The insurance company will take over in paying the premium. Mommy Linda left his son a legacy, a legacy of education.

You might ask me, “what happened to Juvy in the story above?”

Now, she currently 53 years old, is cancer-free and enjoying her 3 grandchildren.

A life insurance indeed saved her life.

When it comes to planning your future, NOW is always the best time to start. To learn more about Life insurance or if you need help with your financial plan/ goals, I will help you make it happen. Feel free to contact me.

Read more about life insurance:

- The Top 10 Life Insurance Companies in the Philippines The Most updated and Most Unbiased Review 2014

- 12 Terms you need to know before buying a LIFE INSURANCE

- TERM Life insurance, the Cheapest Life insurance Ever!

- 5 Reasons Why a Single Person with no dependents, still needs a Life Insurance

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

I like this post, Dra! I just cant stop reading from start to end! Good Job po! More power to you & this site!

Thanks Doc. I will add some riders. Very beneficial. 🙂

Thank’s for your effort to come this way. Great help!

my pleasure. Thanks for reading.

Hello po, ako po ay isang seaman ( not officer onboard, working in Tanker ship, sailing worldwide) paano po ako makakuha nang critical illness benefit.maraming salmat po

Pwede po. Email ko po kayo.