This is an update of my last year’s post, The Top 10 Life Insurance Companies in the Philippines The most updated and most Unbiased Review (2012)

This is an update of my last year’s post, The Top 10 Life Insurance Companies in the Philippines The most updated and most Unbiased Review (2012)

New Update:

Top 10 Life Insurance Companies in the Philippines 2015

It’s February 2015, the Insurance commission hasn’t yet released the 2014 ranking of the top insurance companies in the Philippines. They usually release it every August of the current year. The latest I can give you are 2013 rankings and in case of the Philippine Stock Exchange (PSE), I will be giving the much more current November 2014 market capital ranking.

Since this is an unbiased review, I will not only highlight one category just to make one insurance company look good. I will be enumerating all the rankings in all categories from the Philippine Stock Exchange (PSE) and Insurance Commission (IC). That’s why this is an UNBIASED review.

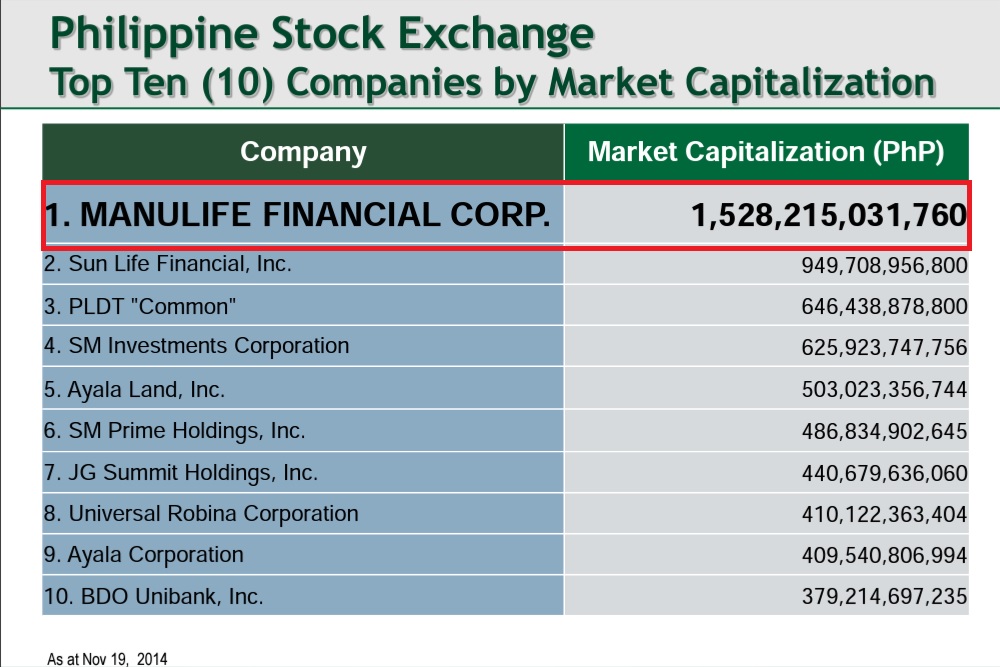

First Category: Top 10 Companies in the Philippines, According to Market Capitalization by the Philippines Stock Exchange (PSE)

Investopedia defined Market Capitalization as – the total dollar (Peso) market value of all of a company’s outstanding shares. Market capitalization is calculated by multiplying a company’s shares outstanding by the current market price of one share. The investment community uses this figure to determine a company’s size, as opposed to sales or total asset figures.

Please note from the 10 companies in the Philippines stated below only 2 companies are from the insurance industry. Manulife Financial Corporation still landed at the number 1 spot with 1.5 Trillion Pesos over 1 Trillion Pesos Market capital last year and Sun Life Financial Inc. moved up in top 2 slot with over 900 Billion Market capital. Last year they were in 3rd place.

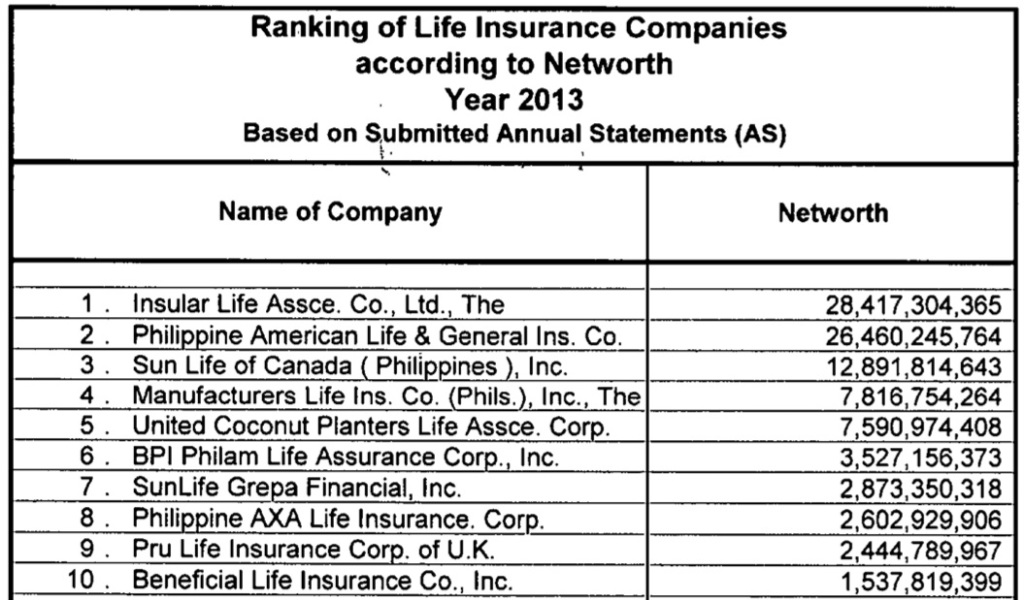

Second Category: Top Insurance Companies, According to Net worth by the Insurance Commission (IC)

Second Category: Top Insurance Companies, According to Net worth by the Insurance Commission (IC)

Investopedia defined Networth as – The amount by which assets exceed liabilities. The company’s net worth is calculated by subtracting the liabilities from the assets.

The leading insurance company still from last year in this category is: Insular Life with 28B Net worth

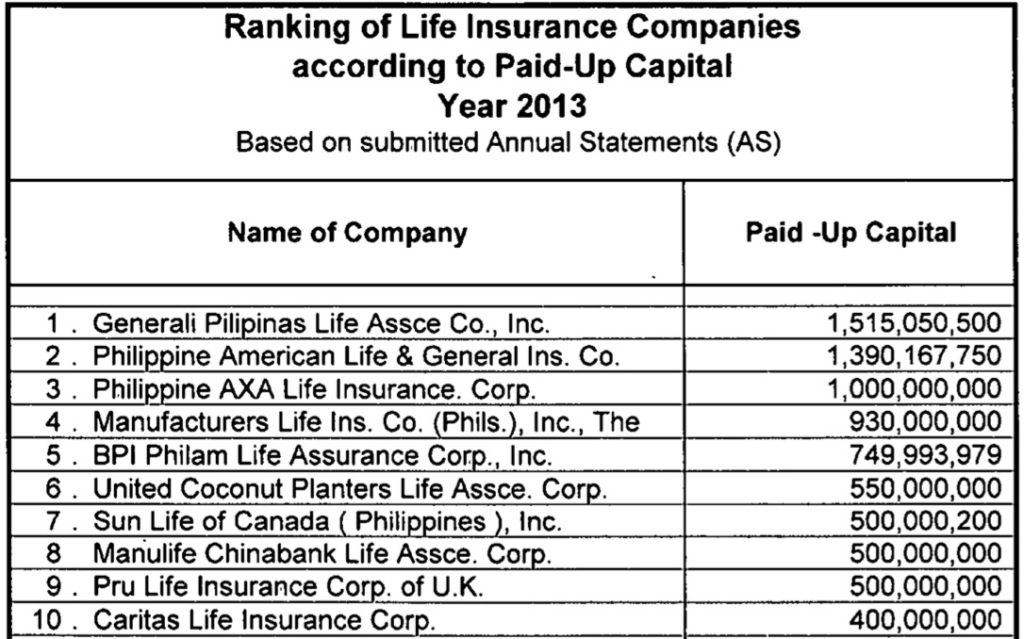

Third Category: Top Insurance Companies According to Paid-Up Capital by the Insurance Commission (IC)

Investopedia defined Paid-Up Capital as – The amount of a company’s capital that has been funded by shareholders. Paid-up capital can be less than a company’s total capital because a company may not issue all of the shares that it has been authorized to sell. Paid-up capital can also reflect how a company depends on equity financing.

The leading insurance company in this category from last year and still is: Generali Philippines with 1.5 B Paid-up capital

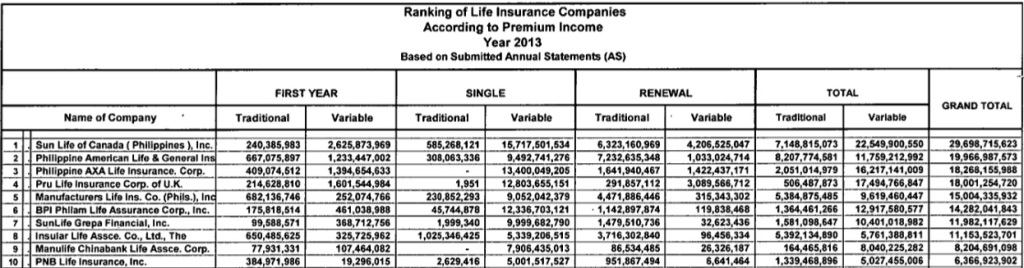

Fourth Category: Top Insurance Companies, According to Premium Income by the Insurance Commission (IC)

Investopedia defined Premium Income as – revenues that an insurer receives as premiums paid by its customers for insurance products. When a customer purchases an insurance product, such as a health insurance policy, the customers cost for a specified term of the policy is called the premium.

The leading insurance company in this category from last year and still is: Sun Life of Canada with 29B Premium Income

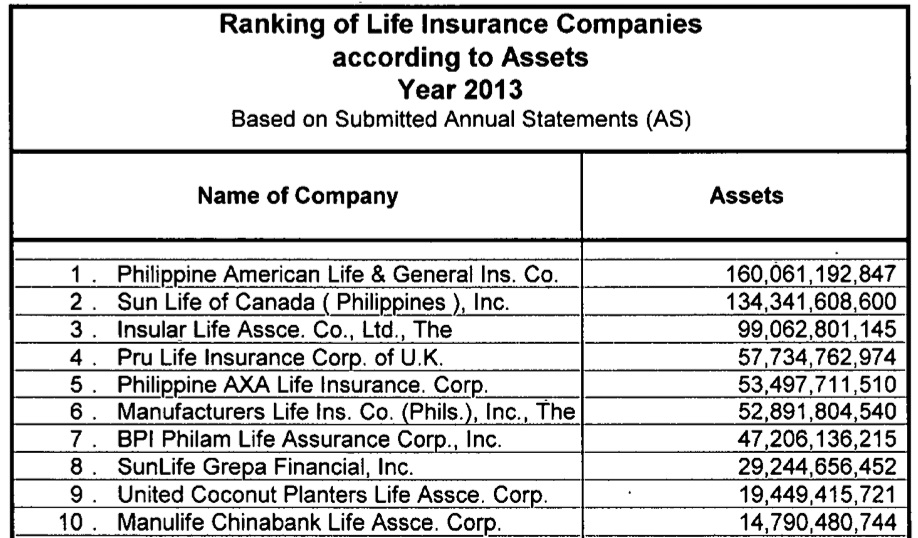

Fifth Category: Top Insurance Companies, According to Assets by the Insurance Commission (IC)

Investopedia defined Assets as – anything of value that can be converted into cash. These could be Cash and cash equivalents, real properties or investments.

The leading insurance company in this category from last year and still is: Philippines American Life (PhilAm) with 150B Assets

Although I represent a great insurance company, I dare say, all life insurance companies are very much the same. They are all stable, has a solid foundation and all are reliable. If until now you are still scared that insurance companies may fall short of their obligations, see here: What is the difference between a PRE-NEED and a LIFE INSURANCE? The most frequently asked question before buying a LIFE insurance?

For me, the more important thing that you have to consider in selecting the right plan for you is choosing the right and reliable insurance agent/financial advisor that you can depend on. The right insurance agent for you will understand you and will guide you on the best possible plan that will suit your needs, wants and budget. Read “5 Insider tips on choosing the right Insurance Agent/Financial Advisor for you.”

In buying a life insurance, don’t let procrastination get in your way. If you don’t know anyone that can guide you in choosing the best policy for you, let me help you with that. You may contact me here.

Good luck on finding your trusted Insurance company and Financial Advisor,

More related readings:

Update: Top 10 Life Insurance Companies in the Philippines 2015

o The Top 10 Life Insurance Companies in the Philippines The most updated and most Unbiased Review 2013

o Life Insurance, How much is Enough?

o 12 Terms you need to know before buying a LIFE INSURANCE

o TERM Life insurance, the Cheapest Life insurance Ever!

o 10 Things You Really Should Know About Your Life Insurance Policy You Never Knew

Sources:

Insurance Commission

Philippines Stock Exchange, Market Capital Category

Investopedia

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Very educational. Thank you for your concern. A must know for everyone.

Hi , I need your help in planning my retirement. Im a pediatrician and my husband is a pediatric cardiologist.

Invest in Stock Market as long as you have a 12-20 years time frame. Stock market investment has the greatest rates of return averaging 13-15% per annum compared to other passive investments.

How come AXA is not here? And I’m sure SUN life is top 1 in the Philippines last year.

you can look at the most recent post. This post is quite old. thanks

hi pls see the link of Insurance commission for latest ranking

http://www.insurance.gov.ph/htm/_statistics.asp

Hello po. Pwede pong malaman kung saan reference niyo sa mga market capitalization in each company? For research purpose lang po

you can go and research in SEC.

[…] The Top 10 Life Insurance Companies in the Philippines The Most updated and Most Unbiased Review 201… […]

[…] The Top 10 Life Insurance Companies in the Philippines The Most updated and Most Unbiased Review 201… […]

[…] The Top 10 Life Insurance Companies in the Philippines The Most updated and Most Unbiased Review 201… […]

[…] The Top 10 Life Insurance Companies in the Philippines The Most updated and Most Unbiased Review 201… […]