In buying your home, it is great to buy in cash if you have the money, since you don’t have to get loans and get to pay higher than the amount because of interest. That is, if you have the money. If you don’t, it’s great to compare housing loan rates from Pag-IBIG and all other commercial before you decide where you want to get your loan.

In buying your home, it is great to buy in cash if you have the money, since you don’t have to get loans and get to pay higher than the amount because of interest. That is, if you have the money. If you don’t, it’s great to compare housing loan rates from Pag-IBIG and all other commercial before you decide where you want to get your loan.

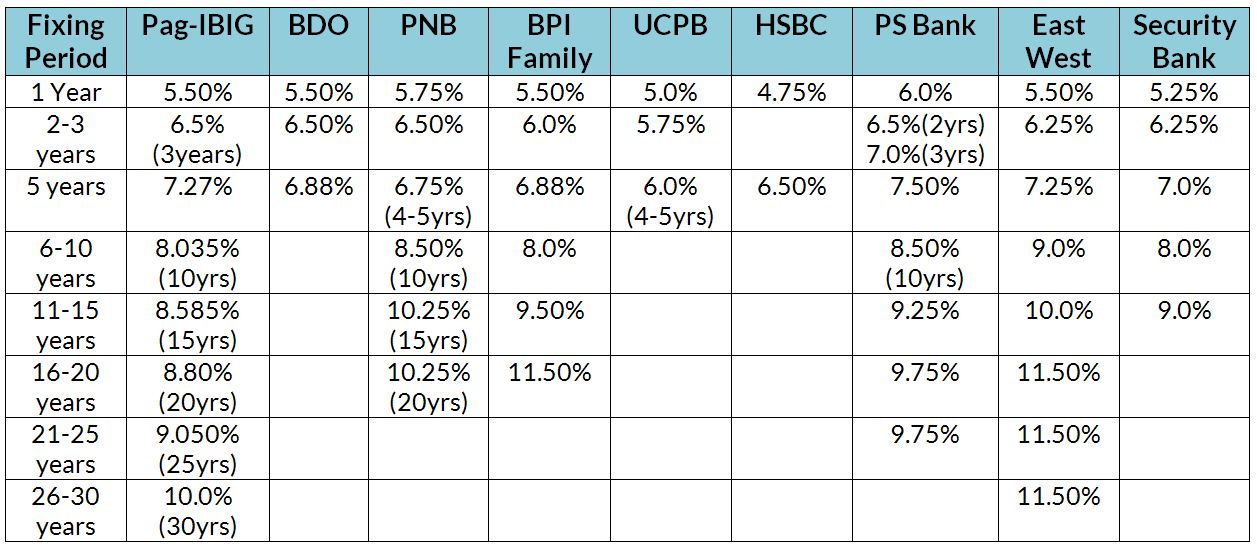

Below is a collection of different interest rates you can compare and can help you decide on where you would loan your first home as of November 2016.

Understanding the table below:

Fixing Period – it is also called Fixed Interest Rate Loan. It is a loan where the interest rate doesn’t fluctuate during the fixed rate period of the loan. This allows the borrower to accurately predict their future payments. (Wikipedia)

*For Housing loans 400,000 and below (affordable housing program), Pag-IBIG offers only 4.50% interest rate. If you are only loaning this amount, Pag-IBIG is a good choice.

IMPORTANT:

1. Please take note that the interest rates quoted in the table above are indicative rates as of NOVEMBER 2016, which means they are subject to change without prior notice, and the actual interest rate will be the prevailing rate during the time you avail of the loan.

While getting the cheapest mortgage or home loan rates sounds great, there are things you should take note:

The lowest rates usually come with yearly repricing, while fixed interest rates are often higher, but can help give you peace of mind that you won’t be affected by the next financial crisis.

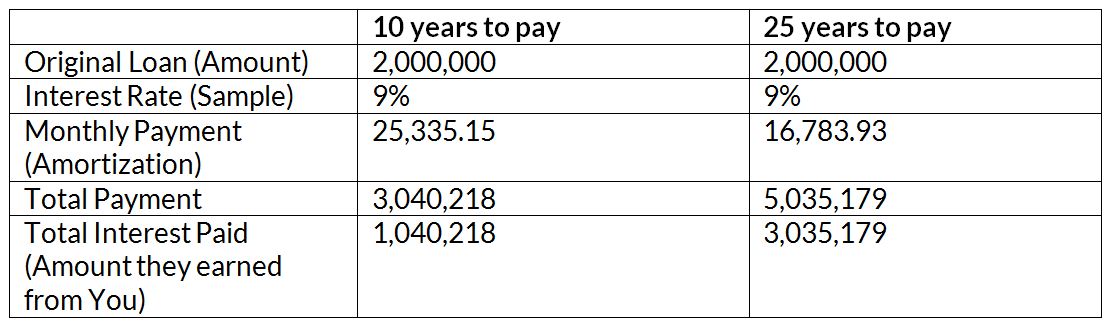

2. The longer paying period, the lower the amortization but, the higher the interest you will be paying.

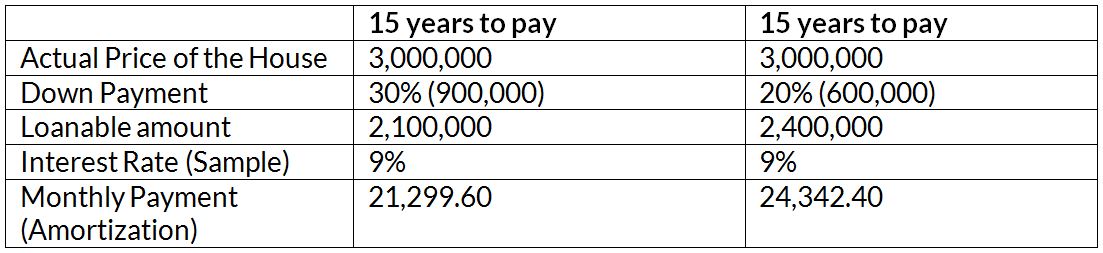

3. The higher the down payment you choose, the lower the monthly amortization.

4. Other things you need to consider is the MRI or the Mortgage Redemption Insurance. It is a requirement in getting a loan. It is an insurance policy that a loaner (person who loans) gets with a death benefit equivalent to the amount that he loaned from the lender (bank).

The purpose of MRI is: in case he dies before paying-off his loan, the insurance company will pay the remaining debt to the lender.

You can get a term insurance or permanent insurance from an insurance company.

In case of Pag-IBIG loan, you don’t need to get this because the insurance premium is already included in the monthly amortization being paid.

If you want to know more about this, contact me here.

Having a home is a dream come true to most Filipinos, but before you decide, it is good to have an informed choice before getting one so you get the best deal with your capability to pay.

Have an informed choice,

Read more:

- Dissecting Pag-IBIG Fund: What is there to Love?

- Dissecting PhilHealth: Know your Rights and Benefits

- Dissecting Social Security System: Rights and Benefits

- Filipino Worker Benefits, What is Available to you?

- TERM Life Insurance, the Cheapest Life Insurance Ever!

Sources:

Commercial Banks Websites:

BDO, PNB, BPI Family, UCPB, East West Bank, HSBC, PS Bank, Security Bank

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Thank you so much for the simple ways of presenting each topic esp related in financial planning. very imformative & useful . .God Bless!

Thanks for reading. 🙂

Hi Dra. Pinky,

You mentioned a HDMF-housing loan 400k and below is with interest of 4.5% only. When did it start? May na-loan kami 384,500 lang na-grant ng Pag-Ibig last 2006 with 6% interest payable in 20yrs. Can we do something para bumaba ang interest rate ng remaining balance namin? Since bumaba na pala ang interest rates nila ngayon.

Ah recent palang rule nila yun. You can try asking Pag-ibig if ok to have it adjusted. 🙂

Good morning Dra. Pinky,

I have an issue. I am a natural born former Filipino citizen, who now holds a passport for the country

of Germany. And according to German Law, there is no way for me to get a Dual Citizenship.

I want to retire in the Philippines in the future and now thinking of purchasing a residential property . Can I avail a regular home loan policy through Pag -IBIG?

Your response would be greatly appreciated. Thank you and God bless!

tanong ko lang po maam, pwede po ba walang downpayment sa bank housing loan?

Humihingi talaga sila ng down payment. Usually 20-30%