If you’re an employee, you’ll see a number of deductions on your pay check every month. One of those goes to Pag-IBIG, the home development mutual fund.

This is the 2nd part of the series, learning our basic Filipino finance. The first part was, “Dissecting Social Security System (SSS) It Pays to Know Your Rights and Benefits.” For now, we take a closer look on what Pag-IBIG can do for you.

What is Pag-IBIG exactly?

Pag-IBIG has a meaning. It is Pagtutulungan, Ikaw, Bangko, Industriya, Gobyerno.

This fund was created in 1981 under two mandates. First, is to set up a forced saving scheme for all the Filipino workers. The republic act of 9679 which was passed in 2009, states that every Filipino worker who earns at least 1,000 pesos should be a member of Pag-IBIG fund. All the formally employed and even household helpers, jeepney drivers should be members of the fund.

What does Pag-IBIG do to all the funds collected?

The second mandate of Pag-IBIG is all about how the funds would be invested. The funds collected are placed in housing development projects in the form of housing loans. The mandate is, 70% of investible fund should go to housing either by: lending to the developers to cast up the housing project or by loaning it to the end users and members who want to buy a house, a condominium, or a lot or if they want to construct a house on the lot that they own.

How much of a person’s salary is actually collected mandatory with the Pag-IBIG?

Under the implementing rules of Pag-IBIG, a person will have a maximum of 100 pesos as monthly contribution. The counterpart of the employer is an equivalent amount which is also 100 pesos. If you are self-employed, that is 200 pesos.

Does the money in Pag-IBIG earns? If it does, how does it earn?

During the time that your money is with Pag-IBIG Fund, it earns dividends because they also lend it out with an interest rate. In some year, Pag-IBIG declared a 4.13% dividend rate which is much higher than the interest rate if you put the money in the savings account in a bank. In a way, it is saved in a higher interest earning vehicle.

Do you get back all that you put on the Pag-IBIG Fund?

The membership period with the fund is 20 years. At the end of 20 years, the member has an option to withdraw all the money from account statement, you’ll see your breakdown how much the money was contributed, how much was the employer counterpart and how much is the dividend. So basically at the end of the 20 years, the average amount is like 60,000 pesos. One-third is the members’ money, one-third is the employer’s counterpart and a third is the dividend.

The mandatory period wherein the money stays with the Pag – IBIG fund is 20 years, what are the instances where the member can get it prematurely?

Pag-IBIG will give the contributions prematurely or less than 20 years in cases of: Death of the member (his heirs will receive it), in cases of retirement, or migration to other countries. Pag-IBIG shall release their contributions.

What if I want to contribute more than 100 per month, can I do that? Will my employer also match my contribution?

Yes, you can increase your contribution, Pag-IBIG is actually encouraging their members to increase their savings, since it is actually like a bank but earning at a higher interest. The employer is mandated only to contribute 100 pesos per month, but they are free to match the contribution of their employees if they want to.

HOUSING LOANS

FOR MINIMUM WAGE EARNERS

With minimum wage earners, there is a preferential interest rate or a subsidized rate at 4.5% Per annum. If your gross income is 15,000 and below (employed in the NCR), then you’ll qualify as a minimum wage earner. All house helpers can also qualify here. The maximum loan period is 30 years and they can borrow up to 400,000 only.

FOR LITTLE MORE THAN MINIMUM WAGE EARNERS

Now if you’re a little over 15,000 in gross income up to 17,500 and you can borrow up to 750,000, the interest rate will be also be low at 6.5%. It is called the subsidized or what they call as the socialized housing program.

FOR REGULAR MEMBER (Non-minimum wage earners)

This is also called the End-User Financing (EUF) Program or regular housing program. The borrower can borrow up to 6M depending on his gross monthly income. The interest rate is at 7.98%, which is really the market rate, the maximum loan period is still 30 years, the different bracket of the allowable loans for different gross incomes is available on their website: www.pagibigfund.gov.ph.

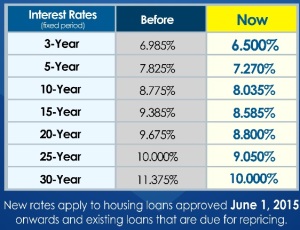

Update: “Starting June 1, 2015, the interest rate in Pag-IBIG would be at all-time low of 6.500% but 3-year fixing period is required. This means that if a borrower chooses the 3-year fixing period, he is protected from the interest fluctuations for 3 years. The shorter the fixing period the lower the interest rate.”

RULES FOR ALL THE HOUSING LOANS

The loan period is up to maximum 30 years or granting that the member is 70 years old at the end of the loan period. So that means if you’re 50 now, the maximum loan period possible is 20 years.

For those who are nearing retirement, Pag-IBIG advises that they ask their children to take out the loan instead of them. How they are going to pay their children is up to them.

In some commercial banks, why are their rates much lower?

You’ll hear about 5.188%, which is a “come-on rate” by some banks, but that’s an interest rate for only a year. After a year, they’ll reprice it and it will be at the market rate. Pag-IBIG is 50% of the mortgage industry so pretty much that is the market rate.

What if I am just a new member of Pag-IBIG, can I immediately avail of a housing loan?

Pag-IBIG don’t actually have a seasoning period. Meaning you can avail of the loan as soon as you became a member.

Darlene Berberabe the president and CEO of Pag-IBIG fund says during in her interview in On the Money: “For example, we have an individual who’s not yet a member and becomes a member now by registering online. Let’s say for example, he wants to borrow 1,000,000 pesos, we will just require a lump sum requirement so that other members who have been with the fund for a long time would not say “O, you’re using my money.” So we’ll ask him to pay a lump sum amount which is 24 months or 24 times the upgraded contribution because we will require the borrower to upgrade the contribution from 100 pesos to a certain amount, depending on the loan amount. So for example, with 1,000,000 pesos, we’ll require you to pay 450 pesos a month. So times 24, that’s 10,800 pesos. So put that to your account, which is your money. We’ll return it, but just so you contribute more to the fund, and then now you can avail of the 1,000,000 depending on your capacity to pay”.

MULTI-PURPOSE LOAN

You can borrow up to 80% of your existing contribution. You can use it in any ways you want like for tuition fee, or vacation or for enrollment in a gym class. The interest rate is 10.5% per annum, payable for 2 years, with a grace period of 3 months.

CALAMITY LOAN

There is an average of 22 typhoons per year in the Philippines. If your Local Government Unit (LGU) declared that your area is in a state of calamity then this will become available for all those who want to avail. The interest rate here is much lower than the multipurpose loan which is only 5.95% per year payable for 2 years. Calamity Loan can be availed within a period of 90 days from the declaration of a state of calamity.

Reasons why it is good to invest in Pag-IBIG fund:

Atty. Berberabe says, “Number 1: It is government guaranteed you won’t be afraid that it will close like the banks as long as there is the Philippine government. Number two, the dividends earn is tax free compared to banks, your interest will have withholding tax of 20%. And number three, we have very good rates.”

What if the property that I got from Pag-IBIG gets foreclosed Can I get it back?

Under our law, there is a 1 year redemption period from the time it was foreclosed. If you want to redeem your property, they will give restructuring program and preferential rates to the person who occupy the acquired assets.

Latest news on Pag-IBIG:

Pag-IBIG Fund disbursed a total of P40.6 billion in 2014 – the highest since 2011, for the housing loans of Pag-IBIG members, equivalent to the acquisition and construction of 54,026 housing units. 2011 is the year when the reforms were implemented after the Globe Asiatique controversy in 2010.

Knowing what Pag-IBIG fund can offer to those who want to have a house they can call their own is the very reason why Pag-IBIG fund was established. There are 12 Million Members of Pag-IBIG fund, but there are only 60,000 home loan borrowers and 2.5M multi-purpose loan borrowers each year. It’s time to maximize what this fund can do for all of us.

Helping you become financially literate everyday,

More to read to become financially literate:

- SSS Retirement Benefits, Updated 2014 Is it enough for your Retirement Needs? Find Out now!

- Dissecting Social Security System (SSS) It Pays to Know Your Rights and Benefits

- Filipino Worker Benefits, What is Available to You?

- Why are Most Filipino Doctors not RICH? Top 5 Obstacles Keeping Filipino Doctors from Becoming Wealthy

Don’t forget to share the love by sharing this article. Just push the Share button.

Do you want to level up? Make me your mentor. Contact me here.

Disclaimer:

I am not associated with Pag-IBIG, I am not an employee of Pag-IBIG. If you have more complicated questions about loans you can ask in any Pag-IBIG branches near you.

Some of the figures may be not so exact due to latest developments, but I did my best to give you the close to exact figures as much as I can give you.

Sources: www.pagibigfund.gov.ph, ANC On the Money

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Good day Doc Pinky. I would like to ask if moonlighting doctors are classified as Voluntary members or are we a part of the Mandatory class? Thank you.

Depende if employed or self employed status mo. But mostly, moonlight doctors are voluntary.