Let me start this part two with a story.

This is a story of Mr. Masikap. He was born poor, as a child he worked as a shoe shine boy. But because of his dream and love for his family, he worked hard. He was able to put up a shoe business and was able to build an empire. He did everything to succeed and he eventually did. He also got married, but his wife died shortly after giving birth to their twins. His sons eventually got married and gave him 10 grandchildren. He was very proud of his accomplishments and is very happy to pass on his entire wealth to his children and grandchildren when he suddenly suffered a heart attack and died at age 65.

Not knowing anything about estate tax before he died. He didn’t know that he’s setting up his family for a disaster.

The story above is a classic story with Estate Taxes but so you know, it is true and happens every day. It is so sad that a person who worked so hard in creating wealth for the family yet, did not know anything about estate tax and what it could do with his estate and his family. Maybe because he did not have a previous experience before coming from a poor family, or maybe he is just too busy in creating wealth that he did not bother to know how to protect it or maybe he did not listen to a financial adviser who came to him to talk about it?

We don’t know the reason, but the fact remains that he was not able to protect his wealth.

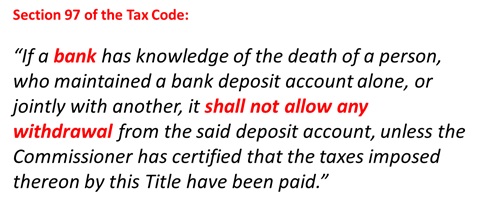

Now, I will share with you different tools that are used in settlement of Estate Taxes. I will be discussing the first 2 options. Since this post will be very long if I include everything. But before I continue, let me tell you a very important tax code that will be an essential part of the discussion.

Meaning to say, all your money in your banks, even in mutual funds, stock market, time deposits will all be frozen or cannot be withdrawn from or used until estate tax if paid. It only means, your heirs cannot use your money in banks to pay the estate tax due.

Different Settlement Options:

1. Liquidate Part the Estate

This is what happens to those who do not prepare like Mr. Masikap. He worked hard in creating wealth, but since he did not know how to protect it. He died without knowing about estate taxes.

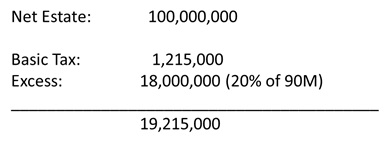

How is an estate tax computed if Mr. Masikap has a 100M worth of the Estate. See Tax Table.

His heirs are left without knowing what to do. They need to pay 19.2M for estate tax due. Suddenly his children do not know how to come up with the money, their only option is, to sell the properties. So, instead of passing on an estate worth 100M, his children had to sell part of it, to generate the 19.2M within 6 months for estate tax dues. If not, they will be fined an additional 25%. See first article regarding charges.

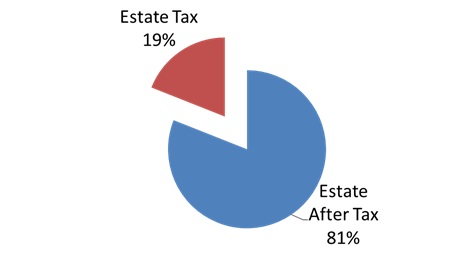

If we illustrate it, it looks like this. His estate is not anymore intact. Almost 20% are sold. But since they are desperate to sell it as soon as possible. Good properties are sold first and at a lower price than their genuine value since they require the money soon enough.

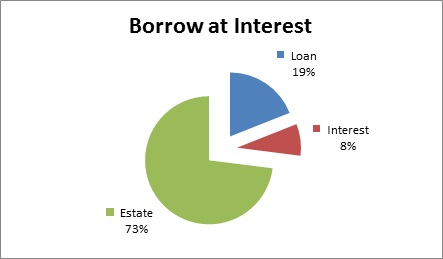

2. Borrow Money at Interest

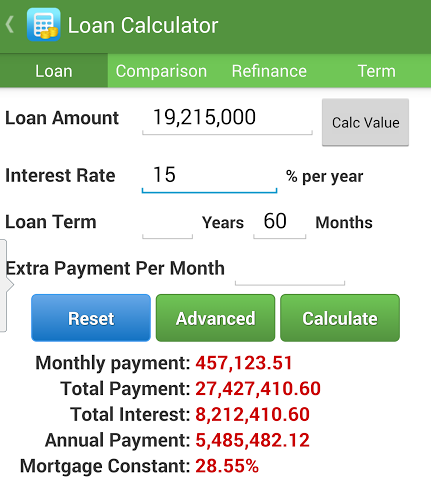

The second alternative is a lot worse than the first one. This happens if they don’t want to sell the properties or nobody there is willing to buy the properties. They borrow money in the banks, of course with interest. The median interest rate of most banks today is 15-25% depending on negotiations.

Total loan is 19,215,000, total interest need to be paid in addition to the loan is 8.2M pesos at 15% interest. That is additional 8M pesos.

Total loan is 19,215,000, total interest need to be paid in addition to the loan is 8.2M pesos at 15% interest. That is additional 8M pesos.

If we illustrate, it looks like this. Instead of leaving behind 100% of his estate, it is now down to 73%.

As much to Mr. Masikap’s liking, his entire wealth cannot be passed on intact. It is either the family sells it or borrow from bank with interest. It really pays to know. As they say, the more you know, the less you pay, the less you know, the more you pay.

From here, we stopped for a while. The following settlement options will be discussed in the next post. Watch out! The best settlement options is the last one, “Creation of a new estate.”

3. Donate Properties now (Deed of Donation)

4. Sell Properties (Deed of Sale)

5. Creation of a new estate

“If you don’t mind that the Government would be your biggest beneficiary, then you don’t need to plan.”

Helping you protect your wealth,

Watch out for the next part of the series. What to do to Protect and Conserve your Wealth?: Part 3 of Estate Planning 101. Make sure you won’t miss it by subscribing here for free.

Few more good reads:

- Part 1: What is Estate Tax and How it can hurt you even After Death?

- Part 2: Estate Tax Settlement Options: What to do to Protect your Wealth?

- Part 3: What to do to Protect and Conserve your Wealth?: Part 3 of Estate Planning 101

- Part 4: Giving your Wealth too Soon? How will that hurt you too?

- Part 5: The Real Benefits of Estate Planning

- SSS Retirement Benefits, Updated 2014 Is it enough for your Retirement Needs? Find Out now!

- FILIPINO DOCTORS AND TAXATION Part 3: How to file INCOME TAX RETURN as a Physician

Want to talk to me personally? Contact me here!

Sources: “Taken from THY WILL BE DONE – Understanding the What, Why & When of Estate Planning by Atty. Angelo M. Cabrera, ELYON Publishing House,” Tax code of the Philippines and BIR website

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

I’d sure hate for a thieving government to be my main beneficiary.

Thank you Doc Pinky for your articles on Estate Tax Part 1 and 2. I’m learning a lot. Looking forward to Part 3 and more. God bless you more each day! 🙂

my husband died march 2011. we have a conjugal rpoperty in occidental mindoro. what best remedy could i make so that we and my children as the beneficiaries could pay the least possible amount of estate tax? thank you. doris bihis

I’m afraid we can’t do anything to lessen the tax since your husband is already dead. Sorry for your loss. But what I can say is, try to consult and estate tax lawyers so you can process the properties as soon as you can and perhaps get an extra judicial settlement. You have to settle it as soon as you can since the charges are increasing as long as it is not paid.

Hi doc pinky,i just wanna ask if the estate tax can be paid thru installment? My parents doesnt want to discuss about estate tax planning coz they always say they are still alive, thats how closeminded my parents are…can i get my parents an insurance even if they are already 65yrs old, iv heard no insurance company wud accept them or if there are the premium is tooooo much high =( pls help me wat to do to convince my parents to transfer,sell,donate in a corporation…they always told us “bahala kyo”. Most of their assets are in the banks loan, will the basisi of tax is thru net assets meaning less bank loans and other exemptions? Thanks plase advise me what to do =(

Hi Pao, mahirap talaga if they are that close-minded. Estate tax could be settled through extra judicial means when time comes. Dun nyo pwede I pakiusap ng installment or such depends on the advise of your lawyer by that time. Pero as you have read in the article, mas mahirap talaga. Better to protect assets now. Regarding insurance, yes, you can still get an insurance for them, depending on their health status of course. If healthy naman sila, they can still get life insurance. You can choose what type of plan depending on the budget. But another problem that could arise, baka ayaw din ng parents nyo kumuha ng Insurance. Siguro you need to educate them more about this. You can buy book of Atty. Angelo Cabrera, which is one of my sources. It’s “Thy will be done”. Talks about real cases. Baka through there they will open their minds about this. If you need more advice on this. Just email me in my contact page. Good luck.

Thanks doc pinky…sana maenlightened sila, kc namimisinterpret lang ng parents ko pag inoopen ung topic na un…ang dating tuloy parang after ako sa mana or mukha akong pera =( but the truth is iniisip ko lang ung family namin…One more question doc pinky You’v mentioned its thru “net assets” that the b.i.r would compute the estate tax, ibig po b sbihin i leless dun ung mga bank loans? Thanks po ulit

May mga allowable deductions naman. Medyo madetail lang, marami din naman. I may post it on the next of the series para to go about the details.

What if they marriage year 1986? And the husband didnt know that they have property without even knowing because of his oldest siblings they keep it secret.And the guy was the youngest.

What if the man is died, was his wife have the right to take for what his husband shares?

Hi, if marriage took place 1986, then the husband and wife will have separate assets before marriage, but after marriage, the fruits of their labor that came when they are already married is the only one that becomes conjugal.

When parents die, their property will be shared among all compulsory heir (legitimate children) equally. If the oldest sibling kept it a secret, the youngest still have a part of the property. He can attest that to a court since he is a compulsory heir.