“The more you know the less you pay.” This has been my mantra ever since I started MYFINANCEMD. It is very much true since, from my first pregnancy, I didn’t know that there is such a thing like this that I can get a maternity benefit just by contributing to SSS. And I paid the price of not knowing this during my first pregnancy. I did not get any benefits from SSS, just because I DID NOT KNOW.

“The more you know the less you pay.” This has been my mantra ever since I started MYFINANCEMD. It is very much true since, from my first pregnancy, I didn’t know that there is such a thing like this that I can get a maternity benefit just by contributing to SSS. And I paid the price of not knowing this during my first pregnancy. I did not get any benefits from SSS, just because I DID NOT KNOW.

Since knowing this vital piece of information I said to myself, this will not happen again. The moment I knew I was pregnant for the 2nd time around, I immediately went to the nearest SSS branch and know what to do to get this maternity benefit. I gathered all these information and after giving birth, I received a total of P41,600.00 from SSS. Yehey!

There are 6 things you need to know and do to be able to avail this benefit and these are:

- Know if you are qualified to get a maternity benefit.

The qualification is: You have paid at least three (3) monthly contributions within the 12-month period immediately preceding the semester of her childbirth or miscarriage.

Huh? Ano daw yun? Let me break it to you gently.

Step 1: Know your EDC (Expected Date of Delivery). This is from your Obstetrician or from your first ultrasound.

For example:

Your EDC is August 1, 2018.

Step 2: Strike out the quarter where your EDC falls, and the quarter before that. The 2 quarters before that, will be the ones that will be included in the computation if you are qualified to receive a maternity benefit from SSS.

The green highlighted rows are the months you need to have contributed to SSS to be qualified; you need at least 3 out of 6.

3 out of 6 contributions will entitle you to minimum benefits.

6 out of 6 contributions will entitle you to maximum benefits.

If I were you, aim for the 6 months, especially if you are a voluntary contributor.

2. How much will be the maternity benefit?

This is the most important thing you need to know. It is the money you will be receiving after birth.

Count the number of contributions you have or will contribute into. (the ones in the green boxes above)

This is the formula:

Maximum Maternity Benefit: (6 months)

Daily Salary credit x 60 days = Normal Delivery

Daily Salary credit x 78 days = Caesarean Delivery

Minimum Maternity Benefit: (3 months)

(Daily Salary credit x 60 days)/2 = Normal Delivery

(Daily Salary credit x 78 days)/2 = Caesarean Delivery

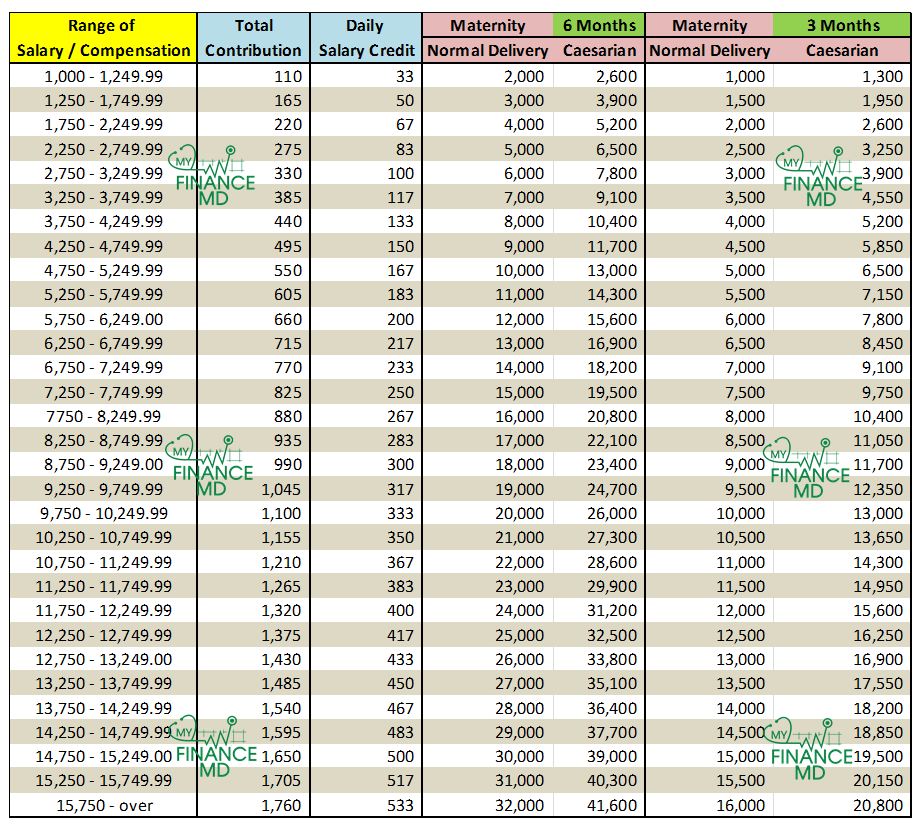

Since I don’t want to make it hard for you, let me spoon feed it to you. The only thing you need to know now is how much you’re contributing every month. Look at the table below for your maternity benefit.

3. Once you have identified that you are qualified to get a maternity benefit and you already know how much you are getting, now you need to notify SSS that you are pregnant.

For voluntary contributors – Notify directly SSS by submitting MAT 1 – together with your first ultrasound (proof of pregnancy).

For employees – Notify SSS by submitting MAT 1 – together with your first ultrasound (proof of pregnancy) to your employer.

Download form here: Maternity Notification/MAT

4. Continue contributing to SSS. If you can back pay the months you were not able to pay, then do it. Usually, this can be done if you are a voluntary contributor. You can pay the months that you have not contributed as long as it is included in the quarter of the month you are still in.

Example:

It’s already December 2017 and you have not contributed to October and November. If you are a voluntary contributor, you can pay the 1 quarter (October, November, and December) as long as you are still in December and as long as you are not yet past the deadline. Pay the maximum contribution if you can, so you can avail the maximum benefit.

5. Once you gave birth, as soon as you can, submit your Maternity Reimbursement Form/MAT 2, along with other requirements then do so, so that the process of reimbursement will begin, which will be more or less 30 days from the day you submitted the requirements below.

For Voluntary contributors:

Present the following the original/certified true copy along with photocopies of the documents. They will only get the photocopy but they will compare it with the original or certified true copy.

For Normal Delivery

- Child’s birth certificate duly registered with the LCR

- Maternity Reimbursement Form/MAT 2,

For Caesarean Delivery

- Child’s birth certificate duly registered with the LCR

- Maternity Reimbursement Form/MAT 2,

- Operating Room Record (ORR) (Certified True Copy) – get from hospital

- Complete Obstetrical History (Original) – get from your OB

- Discharged Summary Report (Certified True Copy) – get from hospital

- Medical/Clinical Abstract (Certified True Copy) – get from hospital

- Laboratory Reports (Certified True Copy) – get from hospital

- SSS ID or 2 Valid IDs if no SSS ID

- Deposit slip/Bank Book of your Bank (where you want them to deposit your benefit)

For employed:

Submit the MAT2 and other documents to your employer or as per instructions of your employer.

Once you have submitted the requirements above and the SSS accepted them, they will confirm and encode your information. They will give you the summary of your maternity benefit and just wait for more or less 30 days to have your money deposited in your account.

That’s it. Enjoy your maternity benefit. If you ask me what I did to mine upon receiving the money? I started the education plan for my baby. Since I believe the money is hers and not mine. I got her first VUL policy for her education. And why I did that? Read more here:

Why VUL is the BEST INVESTMENT Vehicle for your Child’s Education

How to get more than 50% discount for your child’s College Tuition fee

MyFinanceMD has the vision of transforming other’s lives by teaching about the importance of Financial Education. In the process of doing so, the first person who benefited in this is ME. I was able to change my financial life by the knowledge I learned and I am sharing to you. I hope you are learning a lot from me. Should you need a Financial Consultant, don’t be shy to contact me, here!

For your Financial Health,

PS: If you are a government employee and you only have GSIS, do you know that you can still avail of this benefit, just voluntarily contribute to SSS.

P.S.S: What if you were not able to get this benefit before, but you know you are contributing to SSS? ANS: You can avail this benefit before the child concern reaches his/her 10th birthday. Ask the nearest SSS how to go about this. You can avail up to 3 children.

Read more:

- The BEST INVESTMENT Vehicle for Your Child’s Education

- 9 Ways On How To Cut The Cost of Having A Baby

- How to get more than 50% discount for your child’s College Tuition fee

- 5 Money Habits To Avoid Telling Your Kids

- The Exciting Effect of Extended Maternity Leave to SSS Maternity Benefits

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

hello po doc. ask ko lang po 10years na po ako sa sss maximum po ang contribution ko kung ittuloy po ako hangagang 60yrs. ako 14years from now makanano ang montly pensionn ko kung itutuloy total hulog 24years po. salamat po.

Pwede po kaya ko mag volunteer ng hulog? tapos huhulugan ko nlng po yung ibang month? pero wla pa po akong hulog sa sss ni isa d po kase nahulugan ng employer ko dati ni isa tpos ngaun wla po kong work? qualified po kaya kung huhulugan ko nlng yung ibang months?

Depende po sa month ng panganak nyo. Please go to nearest sss branch so they can guide you personally.

ask lng poh,28 months poh contribution koh. mgkano poh makukuha koh?

Try nyo po read carefully yung step my step sa blog. Para you can see if pasok po kayo sa benefit.

possible ba makuha ko pa maternity benefit ko since I gave birth last August 2017 and approved naman na mat-1 ko.

yes, you can claim up to 10 years from the time of birth.

Hi dra what if im having a triplets does it mean i can get 3x of my expected maternal sss benefit. As you me tion earlier benefit is granted for 3 children? Hoping for your earliest reply. Thank you

Hi Doc, tanong ko lang po. Nakapaghulog ako ng 11months from Feb.-Dec.2017 sa SSS nung may employer pa ako. This coming May 2018 ang duedate ko. But now, Self-Employed nalang po ako nagresign na kasi. Plano ko quarterly nalang muna ang hulog sa SSS Baleh sa April pa ang deadline ng hulog ko. Maaavail ko ba ang MAXIMUM BENEFIT na 6months for Normal Delivery? Total naman 11months na nahulugan ng company ko ang SSS ko. Thank you po.

I think you can avail the maximum benefit. Sorry for the late reply. I just saw this message now.

Hi Doc, tanong ko lang po. Nakapaghulog ako ng 11months from Feb.-Dec.2017 sa SSS nung may employer pa ako. This coming May 2018 ang duedate ko. But now, Self-Employed nalang po ako nagresign na kasi. Plano ko quarterly nalang muna ang paghulog sa SSS Baleh sa April pa ang deadline ng hulog ko for the first quarter this year 2018 as self-employed. Maaavail ko ba ang MAXIMUM BENEFIT na 6months for Normal Delivery? Total naman 11months na nahulugan ng company ko ang SSS ko. Thank you po sa sagot. And also additional lang din po, nung magnotify din kasi ako sa SSS. Nakita ko ung total contribution ko monthly from Feb.-Dec.2017, puro 1k+ naman po siya. I saw P1,760 ang last na hulog ng employer ko nung Dec. 2017. I just wanna know if i can avail the Maximum Benefit. This is my first pregnancy po pala. Thank you in advance for your kindly response doc. 🙂

Try nyo po gawin yung example step by step procedure sa blog. If you were able to contribute to the qualified 6 months then, you get the maximum maternal benefit. Sundan nyo lang po yung steps.

Hi doc. Ask ko lng po kc pg employed at 5th pregnancy meron cla tntwag n excess of ur mtrnity benefit n mkukuha. Nkpgfile po ako nung buntis ako ng mat1 after 3wks nlman ng ob n anembryonic pregnancy. Dec 11 nghome procedure kmi ng ob ko then ngbleed ako dec 29 transvi ko cleared n xa. Sick leave lng naiapply ko kc feb 13 fit to work nko. Will i stillget the excess? Nkpgpsa po ako ng mat2.

Up to 4 pregnancies lang po yung cover ng maternity ng sss. You can still ask them po para to be sure. If you still qualify.

Hello of ask klng po kung anong month ako dapat mag start ng hulog sa sss ko voluntary po ako ang expected datebof delivery ko po eh october 2018 pwede ko pa ba mahabol para makakuha ako ng maternity benifits? Salamatbpo

Try doing the instructions i put in the post. There is a step by step there. 🙂

Hi po

Na approved nmn po ako tanung ko lang po sa employer po ba babagsak yung cheke??thankyou po

Depende po sa arrangements ng employer nyo with you. You can ask them

Hi po..bakit po kaya mababa na aproved sakin nag verify po ako ng monthly contribution ko nakita ko 880 per month tapos nag start po ako sa trabaho ng oct.2018-hanggang may 2019 naoperaha n po ako ng june 2019 kasi ectopic pregnancy..pero bakit 6,666 lang po matatanggap ko??

Nasa qualified months of contribution ang consider Nila and the amount of the contribution. Dapat to get the maximum, dapat na contribute kayo ng July – December 2018. Buong 6 months. Mas mataas na contribution, mas malaki.

Hi po doc..ask to Lang po..last yr po nanganak po ako last August 2017 naka kuha po ako ng maternity benefits.ngaun po buntis po ako ulit sa November po due date ko,gusto ko po magvoluntary maghulog sa SSS ngaun.can I avail a maternity benefits? Thank u..

Depende po yun sa mga months na nakahulog kayo. Compute nyo po, read nyo po yung post. Nandyan yung step by step. Or better yet, call SSS para ma guide nila kayo.

Wow!!! This is really helpful! Thanks a lot for posting!!!

Hope that helps you.

Hi…I just resigned last March 2018 and based sa computation ng contributions, I can avail the maternity benefits, my due date is in December.. my question is..i am still unemployed since I got pregnant, kailangan po ba maghulog ako until decembef 2018 para makuha ko yung benefits po? thanks

You can continue contribution via voluntary contributions

Hi , ask ko lang po if yung reimbursement for employed member ay sa employer po ba ang direct or sa account mo? Thanks po

Depende sa arrangement. Ask your employer. Or call sss hotline.

Another question lang po maam what if nagpa notify po sa sss as employed pero resign napo ngayon. Qualified pa din ba yun maam para makuha ang maternity benefit? Thank you and Godbless.

Hi dra. Ask ko lng po kelan makukuha maternity benefit. Enrolled dn po ako thru their bank account accredited.. ngpass ako ng july 11. Tpos hndi ako mkalogin sa online nila. Tried dn po un via sms nila. Ang sbi no maternity benefit claim. Ilan days po b mkukuha ang claim. Thank you and more power po.

Usually po within 30 days.

Hi.. sis . Ask ko lang inabot ba ng 1 month yung sss claims mu bago mu nakuha tru your bank account? Thank you!

In my experience, 30 days.

Hi Doc, may question po sana ako about sa amount na pwede ko ihulog, let’s say i will follow your example above, for me to qualify for the maximum maternity benefit, from October 2017-March 2018 i need to pay P1760 po dba, kasi yan ang magiging basehan ng SSS sa computation nila. My question is, after March 2018 onwards, pwede ko na po ba babaan ung amount ng contribution ko? Instead of the P1760, mga P500 a month nlang po cguro para hindi rin masyado mabigat.. Will that work and will i still qualify for the maximum benefit or kailangan po consistent ako na P1760 til i give birth? Thanks!

If voluntary ka. Yes they will allow that.

Mam matagal na po ako ngresign sa work ko kaya nastop po ako maghulog pero nung nalaman ko po na buntis ako nung january 2018 nagbayad po sa sss ko 1760 po monthly contribution ko as voluntary ang edc ko po ai october kaso po napaaga panganganak ko naging september 24 2018 via cs delivery bakit po ang sinasabi sa sss 20,800 lng po ang makukuha ko ? Marami pong salamat sa inyong magiging kasagutan

Kasi 3 months lang yung naka sama sa months na dapat may contribution ka. Dapat nakapag hulog ka ng last quarter ng 2017.

hi doc my tanong po ako na miscarriage po ako then employed po ako tapos april 24 po nag pass na ako ng mga requirements ko tas hanggang ngayon wla pa po ako na claim nag follow up na ako sa hr ko tapos palage lang ako sinabihan na tatawag lang dw po sa production tapos hanggang ngayon wla pa…

Hi Ma’am. It’s been a year na po nung pinanganak ko ang panganay ko. Di po ako nakapag notify sa SSS, wala po akong na sumbit na MAT-1. Sa tingin nyo po ba pwede ko pa ma claim ang Maternity Leave ko? Sana po matulungan nyo ako.

Hi po doc ask ko Lang po Kung pwede pa ako makabol sa maximum sa maternity benefits kc po ang nabayaran palang sep to Nov..employed po ako ngayon..pwede mbayaran ko yong .June to augost?

Usually po if lumagpas na di na sila pumapayag. But pwede nyo po I-try. Ask the nearest SSS branch. 🙂

Hi po. What if po i gave birth last november 2018 but i resigned by may 15, 2018 maximum claim po ba makukuha ko?

Apply the format I gave po. Or you can ask directly to SSS, to be sure.

I am already separated from the company last May 2018 and I submitted a certificate of non advance payment to sss. My question is does sss still confirm or call my previous employer for verification purposes?

Hi doc, my EDC is on Aug 2019, my contributions started again last Nov 2018 because I’ve been unemployed for several months, will I still get the maximum benefit?

If you should be contributing from Oct 2018. But I think you’ll get benefit just not the maximum. You can call sss hotline to inquire.

Hi Dra. This post is so useful! I want to ask still po with my current SSS contributions. I followed the steps however I am not sure kung paano po i-compute yung sa akin. My EDD is on June 2019. I was employed with 2 different companies last year and then nag voluntary pay po ako hence magkakaiba po yung contribution amount. Following the steps, July 2018 P1760 (that was my last employer contribution from a 2 year job) and then August, Sept and Oct 2018 P1650 per month and lastly Nov and Dec 2018 is only P220 pero month. Paano po kaya ma compute eto? Thanks alot in advance po!

Gaano po katagal bago makuha ang sss maternity benifits?

Gaano po katagal bago ma-claim ang maternity benifits sa sss?

30 days.

hi dra ask ko lang po 3months na po since i gave birth naipasa ko na po yung MAT 1 ko ngayon ko plang po maasikaso yung nga requirements sa MAT 2 possible pa po ba mabayaran ako? hanggang ilang months lang po ba ang kailangan para mag asikaso at maipasa ang MAT 2? salamat

hi dra ask ko lang po 3months na po since i gave birth naipasa ko na po yung MAT 1 ko ngayon ko plang po maasikaso yung nga requirements sa MAT 2 possible pa po ba mabayaran ako? hanggang ilang months lang po ba ang kailangan para mag asikaso at maipasa ang MAT 2? salamat

Yes Ok lang yun. Until 10 years old yung anak mo you can claim for that benefit.

Hello Dra. I just wanna ask po on how much i will be getting from my sss maternity benefit since i was employed from July 2017-August 2018 in a private company where they pay 1.760 for my contributions monthly. Then i resigned last Sept 2018 and started paying my contributions as Voluntary (330php monthly) Since my EDC falls last April 2019 will the computation afftected kasi from 1760 to 330 na lang monthly contributions ng sss ko.

Consider those contributions a year before you gave birth. Yun yung affected.

Hi pow doc tanong q lng pow due date ko pow now August 06 2020 tapos sabi ng OB ko CS pow ako 4yrs na pow ako sa SSS magkano pow maternity pay ko kng CS ..tnx pow

Depende po sa contribution nyo. Please refer to the article. And there is newer article on this.

Hi pow doc tanong q lng pow due date ko pow now August 06 2019 tapos sabi ng OB ko CS pow ako 4yrs na pow ako sa SSS magkano pow maternity pay ko kng CS ..tnx pow

hi, use the computation in the blog. There is the step by step instructions there.

Hi Doc, I just wanna ask po sna if my maternity benefit will be affected by an existing loan that I have with SSS once I file the claim? Thanks!

No, they will give your benefit. Loan are paid separately.

Hi Doc. I followed your step by step sample since August 2019 din po ang due ko so i paid the maximum payment for last quarter 2018 n 1st quarter 2019. Pero ng pinacompute ko po makukuha ko is 28k lng daw kasi nag fall daw sa contingency date ang pagbayad ko ng 1st quarter. Naguluhan ako since hindi naman ako na due sa payment. Ang sabi eh new rule daw po?

Mam you can try asking their hotline. 02-9177777. Will try to ask that too.

hi doc my tanong po ako na miscarriage po ako then employed po ako tapos april 24 po nag pass na ako ng mga requirements ko tas hanggang ngayon wla pa po ako na claim nag follow up na ako sa hr ko tapos palage lang ako sinabihan na tatawag lang dw po sa production tapos hanggang ngayon wla pa…

If you want you can directly call SSS hotline. You can ask them too.

Good day po ask ko lng po.nagcheck mo ng maternity benefits ko settled claim last june25,2019..ilang days po process bago pumasok sa account ko..madaming salamat po

Usually 30 days. 🙂

Hello po doc, how to compute po how much kukunin, im due due this August so i followed yung step by step po n sample mo. I paid the maximum for october-dec 2018 and jan-march 2019. Pero nung nagtanong ako magkano makukuha ko is 28k lng daw po since my payment sa 1st quarter falls sa contingency date but i paid before its due? Yung 3 months lng daw po maavail ko in case.. thank po

What do they mean daw po sa contingency date? Do you have receipt for the months of contribution, indicating that you paid maximum?

hi doc asked ko lng po mi mkukuha p poba ako sa maternity ko 1yr and 2months n baby ko now nanganak poako last year june8,2018 normal delivery po ako ganito po kasi un sabi po kasi nung sss branch sa robinson sta.rosa hulugan ko daw ung consecutive 3months pra maavail ko ung maternity ko un nga po nghulog ako covered ng jan-march 2018 ang pgkkmali ko po ndi ko naitanung nang maigi un po pla dapat hulugan ko oct-dec2017 mi habol p po kya ako thank u po doc. sa pgsagot.

If nahulugan nyo po yung Oct – Dec 2017, makukuha nyo po maximum benefit, if Jan to March lang, you get the minimum benefits.

settled claim po ng sept.16.2019 ilan days po bago pumasok sa atm account po kagaya ng landbank

30 days usually

yung 30 days po ba nag start po yun simula ng ma settled claim po? salamat po doc sa pag reply!!😊

Hell po kelan kayo nag file ng sss maternity nio?

hI PO DOCK ASK KO LAng po medyo mapapaaga po ako sa leave march po due date ko dec pa lang po ay mag leave na ko qualified po ba ako sa bagong batas po ngyn na 105days buo kupo kaya makukuha yung sa SSS gayung ang balik kupo sa work ay june 2020?

Depende po if Naka pag contribute kayo ng Tama sa required months na dapat may hulog kayo.

Doc good am po. Ask ko lang po. Pano po pag hndi po ako nakapagnotify sa sss, sa july po due date ko, makakclaim po kaya ako? Nkapaghulog po ako fom oct 2019 voluntary, dting employed until march

Pls call SSS hotline the can access your contribution there.