If you ask me if I am doing my own Income Tax Filing, my answer is YES. I finally did it on my own and I am so proud of myself.

Indeed, “The MORE you KNOW, the LESS you PAY.” The very mantra of the book I wrote.

I don’t need to pay almost Php40,000/year to have someone do it for me. Now, what can I do with that amount? (All smiles here 🙂 )

I am not saying that you fire your accountant right now, I am just sharing to you what can knowledge give you. It’s still great to have someone do it for you. As for me, it’s my choice, so I can better serve my readers and followers who wanted to know more about DIY tax filing.

Anyway, let’ get this going.

April 15 is the new deadline for filing the Annual Income Tax Return (ITR). These are the things you need to know:

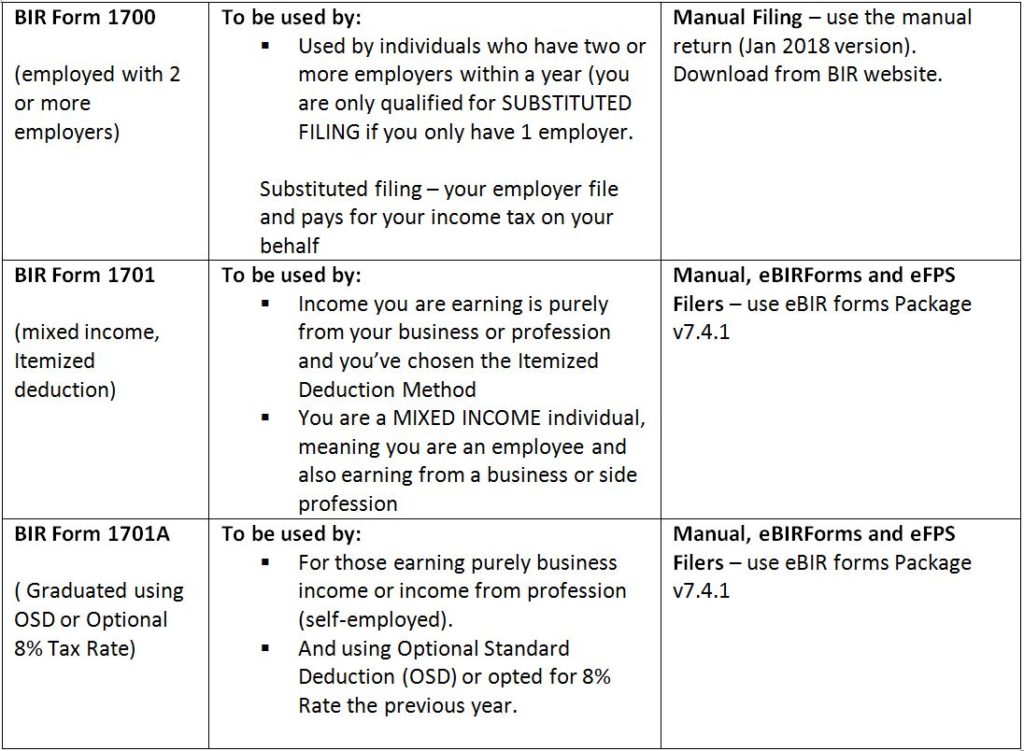

1. There are different available forms for different categories you might be in. These are the forms below and when to use them.

2. What are the steps in filing your ITR using BIR Form 1701A

Step 1: Gather all your BIR Form 2307 for the entire year, your 1701Q (Quarterly Income Tax Returns) you have already filed for the previous year (1st, 2nd and 3rd) and receipts you issued as proof of your income.

Step 2. Input the details in the excel sheet of MyFinanceMD.

Download the excel sheet here by subscribing to my blog:

Click this link below —-

http://forms.aweber.com/form/38/1246521138.htm

How to use the form is show in my vlog last Nov 2018:

Click the link below —–

https://www.youtube.com/watch?v=ArD-ghh4eJs

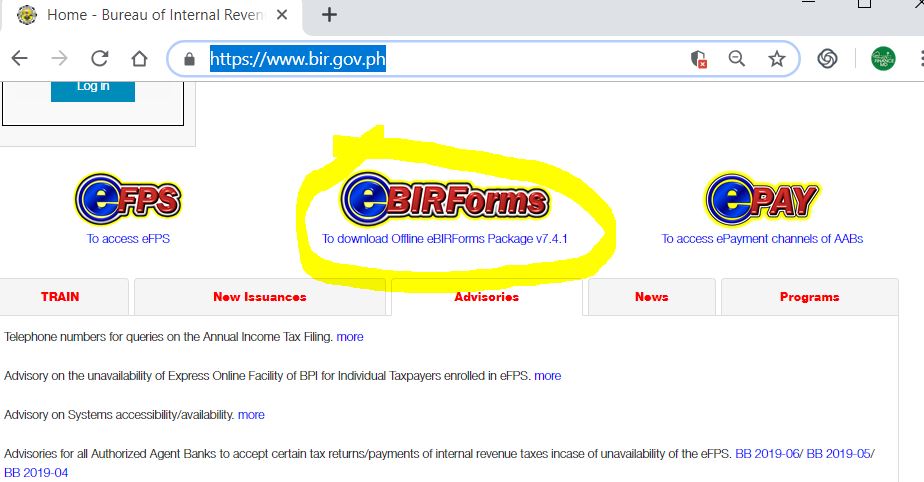

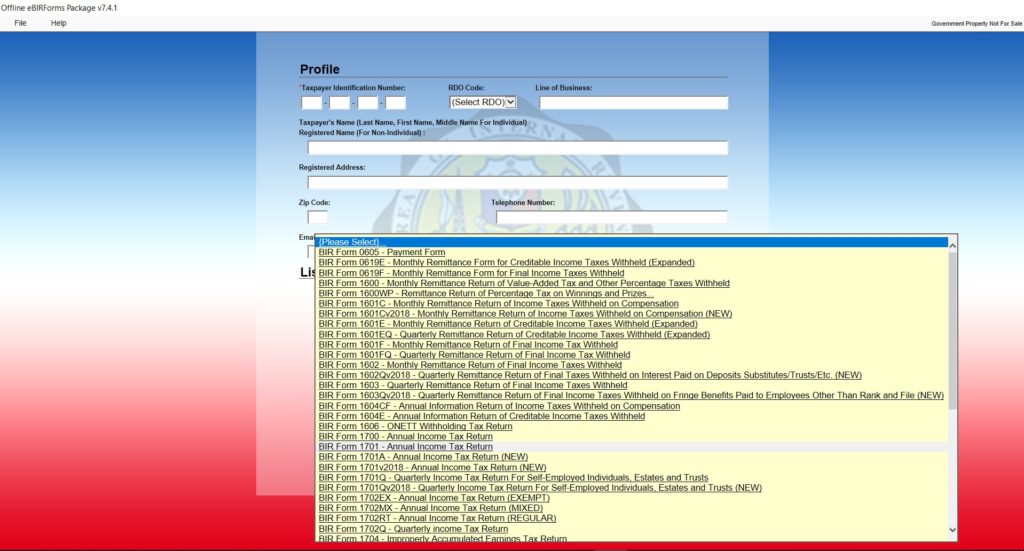

Step 3. Go to https://www.bir.gov.ph/ then, download and install the latest version of the eBIR form

Step 4: Run the program, place your TIN, RDO, and other details, choose the form you need, then fill up the 2nd page.

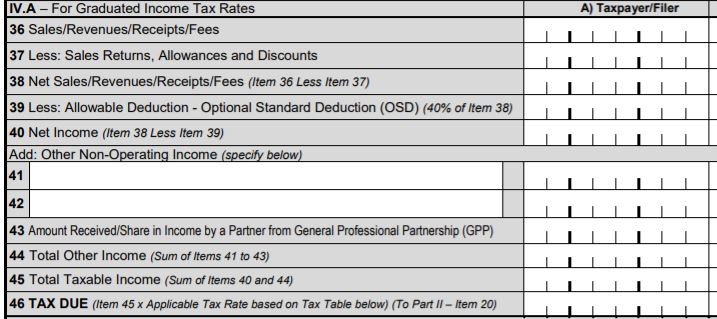

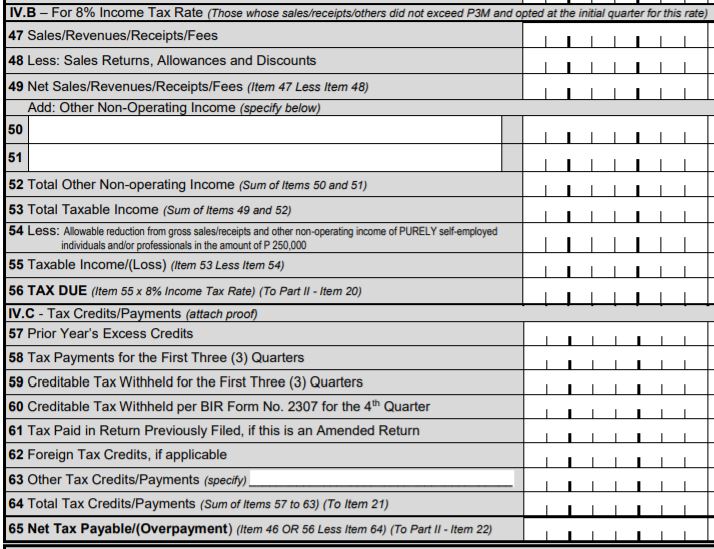

Step 5: For those using the Graduated IT Rates, fill up IV.A and IV.C

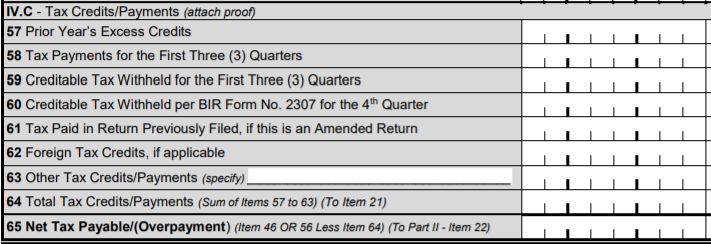

For those using the 8% Income Tax Rates, fill up IV.B and IV.C

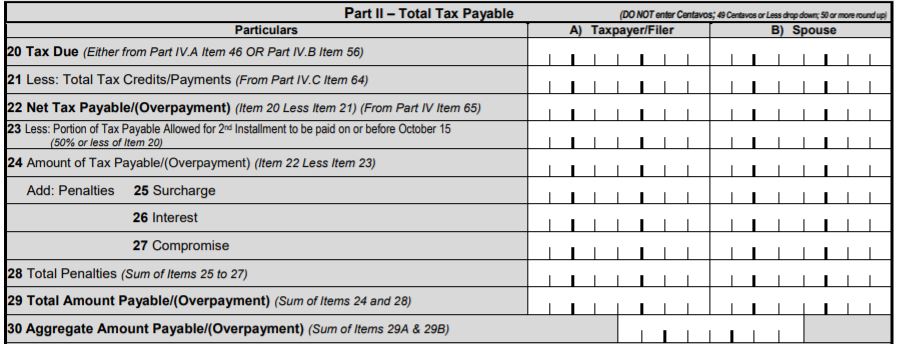

Step 6: Once you filled up above blanks, Part II will automatically be filled. (This part below)

Step 7. Recheck your entries if correct, then Press Validate, then submit FINAL COPY. Print 5 copies of all the pages (to be sure).

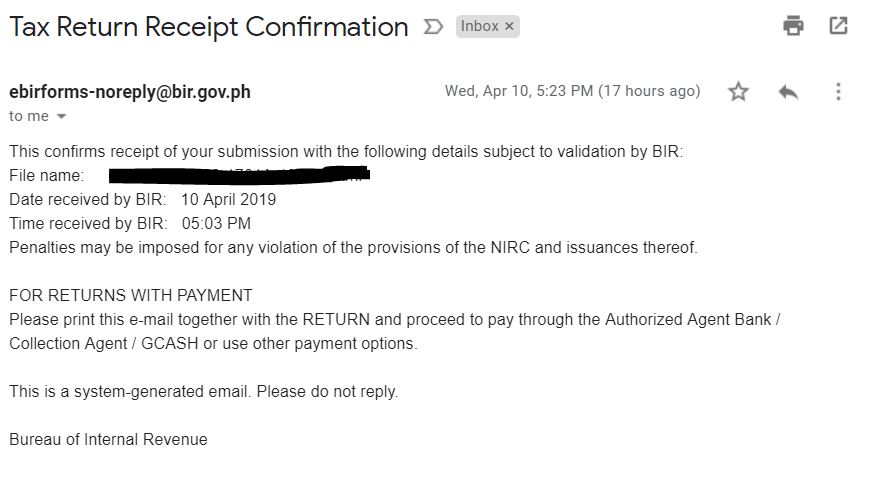

Step 8. Once you submit final copy to BIR, they will send you a confirmation receipt in your email. Print the confirmation receipt.

For those with Payment Dues: Pay to authorized bank of your RDO or you can also use GCash.

For No payment: If you file online thru the eBIRform, no need to submit, just print the email confirmation you have received via your email.

For those using Manual filing: You need to submit and have it stamped in your RDO.

Note: If you have attachments in your form, you need to submit the required attachments to your RDO within 15 days from the date of eFiling.

That’s it. I hope you were able to beat the deadline, or else the penalties and surcharges are real. Be responsible to your own taxes. I did it and succeeded, I know you can do it too. Take note, Authorized banks of some RDOs are open this coming weekend. Make sure to get that advantage.

For Your Financial Health,

Download the TAX CALCULATOR here:

Download the excel sheet here by subscribing to my blog:

Click this link below —-

http://forms.aweber.com/form/38/1246521138.htm

Read More:

- Video: How to Compute your Income Tax Return (Train updated) for DOCTORS AND PROFESSIONALS

- 8% OPTIONAL FLAT RATE vs. GRADUATED TAX RATES, Which is better for Self-Employed Doctors?

- 8 Facts Doctors Need To Know About the TRAIN and How It Will Impact Your Income Tax

Do you want to know how to file your taxes online without going out?

These courses will teach you how to file and pay your Income Tax returns at the comfort of your home.

Start to end, step by step, no going out. From encoding, filing and payment. (All done online)

Enroll in our online course:

For Physicians/Doctors/Dentists/Vets:

https://pro.myfinancemd.com/taxcination/

For Financial Advisors:

https://pro.myfinancemd.com/taxcination-for-financial-advisors/

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Hi Doc,

How is the registration in BIR of individual with multiple professions like you? Does insurance companies accept your COR and sworn declaration as registered doctor, CPA, or lawyer and will be withhold 5% from the commission/other income received ? Thank you.

Hi,

great information income tax, really uses full this post, I like your post, Thank you so much for this post sharing.

Hi! Great, informative, and desperately needed blog!

Before, I files via eBIR, but the RDO still required me to manually submit the form. Even with the email confirmation!

no need right now if you have email confirmation.

how do we certify that the information that we put in our Income Tax Return is really legitimate? I have read before that Income tax return must have an atttached financial statements and audited book of accounts certified by a CPA?

For those using optional 8% and OSD, no need for audited financial statements. When you pay for your ITR you can also submit your 2307 and or 2316.

i still havent recieved my email confirmation for 4 hours now what should i do? does emailing them help at all?

Just wait for it, sometimes it takes time.

Hi doc,

So after sending my 1701A online and receiving the confirmation email..all i need to do is to go to my rdo and have the itr stamped with the 2307 attachments, right?

Thank you

No need, once you get the online confirmation email and paid your dues. Keep the records of your payment and their confirmation.

Do I still need to Attache Balance Sheet and Income Statement? If so, how will I present my Income statement provided that I have used 8% GRT?

Thanks

No need to present any income statement for 8%.