A group of mommies asking questions about stock investing prompted me to write about this and I would like to make it as simple as possible. In helping you to learn more, I provided below some basic slides I used in my financial literacy lectures. Here it goes.

A group of mommies asking questions about stock investing prompted me to write about this and I would like to make it as simple as possible. In helping you to learn more, I provided below some basic slides I used in my financial literacy lectures. Here it goes.

When in comes to investing, there are different categories.

It may be one of these: Business, Real Estate, and Stock investing.

In all types of investments, three things are required. No investment will prosper without one of these three. And these are:

1. Knowledge

2. Time

3. Capital

In Business, you need a lot of studying to become a knowledgeable business owner. It is also only logical that a lot of time is needed for your business to make it grow. Needless to say, you need a capital or money in the first place to be able to create, ran and maintain a business.

Same thing with Real Estates, your knowledge is required so that you could be able to spot a good location and discern a good opportunity. Time, to let that real estate grow in value, and a big amount of capital to be able to buy that piece of land or property.

When it comes to stock investing. All three are also needed. Knowledge where to invest. Capital to buy the stocks/shares and a hell lot of TIME TO MAKE IT GROW.

Stock Investing Could either be of the two:

- INVEST ON YOUR OWN – through a stock broker. Most famous of which is COL Financial. In here you still need a lot of knowledge to be able to watch trends and know which stocks to buy and when to buy. You are on your own, so, it is very important to read, study and have some willing mentors to help you out.

- INVEST THROUGH MANAGED FUNDS

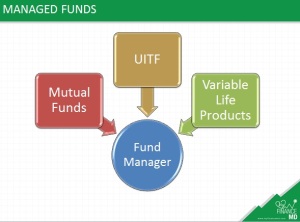

There are three kinds of Managed Funds:

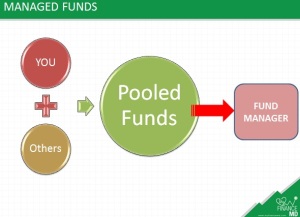

Managed funds operate with the same mechanism. What they do is, they pool the funds from investors, invest it in a stock market by a fund manager. The major difference here are the companies that handles them and government agencies that monitors them.

- Mutual funds – Managed by Mutual fund companies monitored by SEC (Securities and Exchange Commission).

- UITF (Unit Investment Trust fund) – managed by banks, monitored by BSP (Bangko Sentral ng Pilipinas).

- Variable life products – managed by life insurance companies, monitored by IC (Insurance Commission).

Unlike other types of investments, that require a big chunk of your effort through studying and a lot of money to start with, managed funds are a little different.

Managed funds are ideal for those people who has little of those 2 requirements (Knowledge, Capital) but has 1 (Time to Grow).

- Those who lack knowledge – many professionals like to invest. But don’t know how and do not have the time to study. Understandably, since they are very busy. So much too often, they don’t invest. Managed funds are ideal for those who do not have a lot of time to watch and monitor market trends, those who are still starting to learn but wanted to start investing right away. Since the fund managers are the experts who study for them, and has all the time in the world to monitor your stocks.

- Those who lack capital – we all know that in business and real estates, you need a lot of money or capital to be able to start it in the first place. With stock investing, you can start with just as little as 1,800+/month.

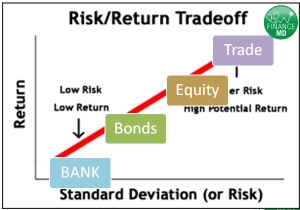

- Those who has a LOT of TIME – stock investing is basically, your MONEY growing over time. So, the more time you have, the more it will grow, the less time you have, the less it would grow. Stock market investing is not instant money as many people assumes. That is stock trading, not stock investing, which is more risky in nature.

All investing has its risks. Right? A food cart business is not a 100% guaranteed success as well as with a piece of land you bought, and of course it is also true with stock investing.

Another basic in stock investing is, risk. The rule is, the higher the potential return, the higher the risk, the lower the potential return, the safer it is, the lower the risk.

In growing your money, always remember the 3 things I required you to have. Knowledge, Capital and Time (to grow your investment). Without one of the three, it will never succeed.

A 14M lotto winner lost his money after 3 months. He has money and time, but no knowledge to sustain him through.

A young and willing yuppie (young urban professional) who just started working, read a lot about investment to grow his knowledge, has a lot of time to grow it, but do not have money/capital yet to start his investment is also a problem.

An old retired employee just received his 3M retirement cheque, may have all the money and gained knowledge but too little time to make it grow.

This post is just the start of your investing journey. This is the start in growing your knowledge. I hope you subscribe to my blog to receive the next part of this series. Which is: Tackling the major similarities and difference of Managed Funds. Subscribe here for free.

More for your Knowledge:

- How to get more than 50% discount for your child’s College Tuition fee

- 10 Things You Really Should Know About Your Life Insurance Policy You Never Knew

- Life Insurance, How much is Enough?

- 5 Insider Tips on Finding the Right Insurance Agent/Financial Advisor For You

- How Financially Smart are You? What is Your Financial I.Q. Take the test and Find Out!

If to learn more, contact me here!

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Very informative & a necessity in helping people understand & achieve their financial goals.

I cant find if theres a part 2

hi Vanessa, still working on i. thanks for reading