When we say VUL, it means: Variable Universal Life. It is a type of permanent life insurance policy with built-in savings/investment component.

If you are the type of person who insists that BTID or Buy term invest the difference is the way to go, this post is not for you. You can check my post regarding BTID mentality, here in this post:

Buy Term Invest The Difference (BTID), is that for me? Myth vs Reality

This article is for those who want to know more about their existing VUL plans or for those who are planning to get one for themselves. I want to show you that there are choices. Your Financial Advisors usually determine what they will suggest to you depending upon your goals and needs at the start of your financial needs analysis. But it doesn’t hurt if you know how VUL plan works, in order for you to be able to ask the right questions and even check if the plan your financial advisor gave you is in line with your PURPOSE and BUDGET.

A lot of people do not know, but, there are 2 major types of VUL products: one geared towards Investment, the other more geared towards Protection.

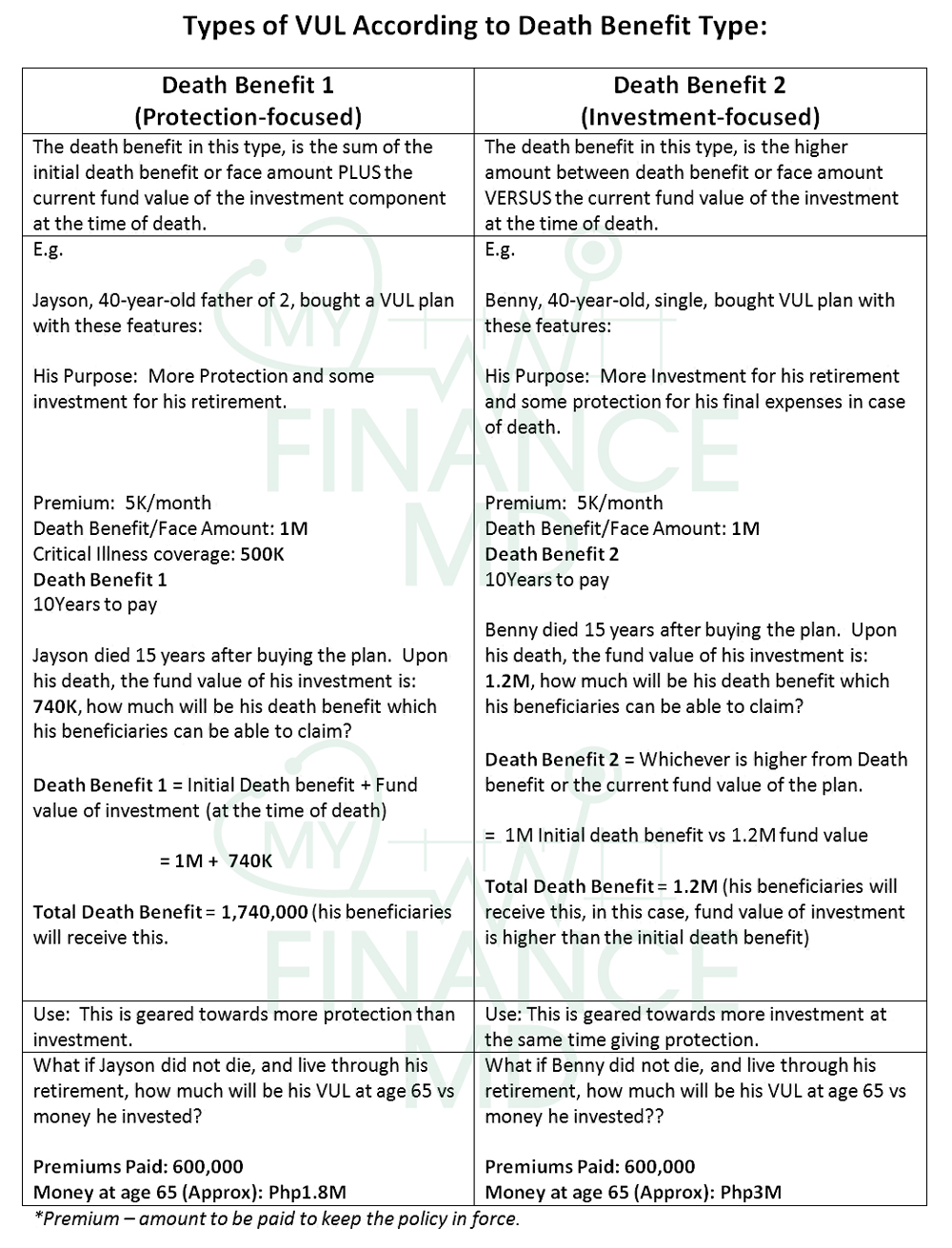

Types of VUL According to Death Benefit Type:

From the above example, you might think that Death benefit 1 is better than the Death benefit 2. My answer is, it depends on the person’s objective and circumstances.

Jayson is a breadwinner with 2 kids, Benny is single and no dependents. Jayson needs more protection than investment, although at the same time he also wants to have some form of investment for his future retirement. Benny just needs basic protection because he does not have dependents that will suffer in case he goes early, his goal is some protection, but more investment, because he is thinking of growing old alone. The difference between the two DEATH BENEFIT is in the fund value of the investment of their plans.

After 15 years of paying the same amount, Jayson has 750K fund value at the time of death, he chose the Death Benefit 1(Protection-focused), while Benny has more, 1.2M at the same time since he chose the Death Benefit 2(Investment-focused).

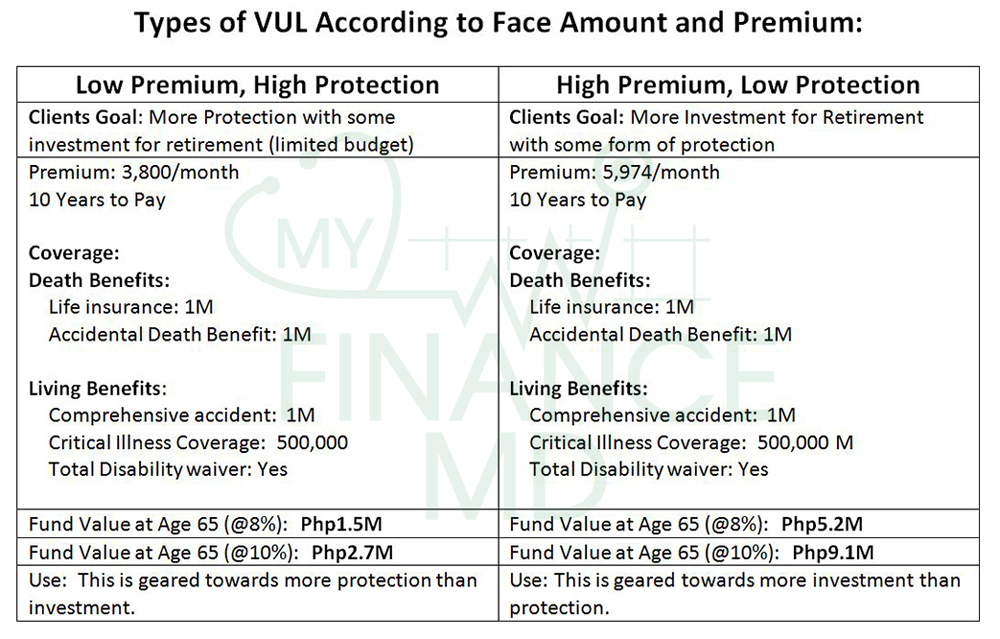

Types of VUL According to Face Amount and Premium:

As you can see even with the same benefits, the premium is relatively high on the right table more than the low premium on the left side.

Usually this type of VUL is not always available to all insurance companies. Some insurance companies that have this feature has some kind of multiplier. Where they can control the face amount/death benefit depending on your purpose. Ask the insurance company you are eyeing if they have this feature.

Another use of High Premium, Low Protection, is in the education plan of your kids.

See this post regarding that: The BEST INVESTMENT Vehicle for Your Child’s Education

There you go, these are the types of VUL you might want to know at the depending on your needs and requirements. Now that you know, don’t just say yes to the plans your financial advisors give you. Make sure what they give you is in line with your purpose and budget.

Be wise, the more you know, the more you earn.

Wishing you the smartest choice,

Read more:

- Buy Term Invest The Difference (BTID), is that for me? Myth vs Reality

- Difference between UITF, Mutual Fund and VUL

- 3 Genius Reasons Behind VUL (Variable Unit Linked) Insurance

- TERM Life insurance, the Cheapest Life insurance Ever!

- Where do UITF, Mutual Fund, and VUL Invest your Money?

If you need Executive Financial Check-up for FREE, contact me here.

Latest posts by Pinky De Leon-Intal, MD, RFC (see all)

- Say Goodbye to Chronic Lifestyle Diseases (Hypertension, Diabetes, Cancer, Gout, etc.) with Right Food and Right Water - 23 May, 2023

- Embracing Superpowers: A Mom’s Journey as a Doctor, Professor, and Financial Consultant - 19 May, 2023

- Celebrating the Power of Women: Honored by Philippine Daily Inquirer - 17 May, 2023

Hi Doc Pinky,

Very well explained. This is the advantage of VUL compare to BTID. I have a VUL which I started 2 years ago wherein it is more on protection-focused since I am already above 50 years old and my minor twins have VUL which is more on investment-focused as they need these investments for their retirement purposes.

As the saying goes, investing and risking money are the key factors in gaining financial freedom.

Gee